A new research paper from Beagle Street estimates the financial risk for householders who have not taken out life insurance cover for their mortgages, across England, Scotland and Wales. The study found that over £400 billion of mortgage debt is not covered by life insurance in Great Britain.

In the current atmosphere of cost-of-living increases and continued economic uncertainty, it may be tempting to avoid taking out life insurance protection. This is particularly true for life insurance cover on the biggest loan most families have: their mortgage. Yet these very factors which are increasing financial pressure will also increase financial distress for a family in the event of an unexpected premature death.

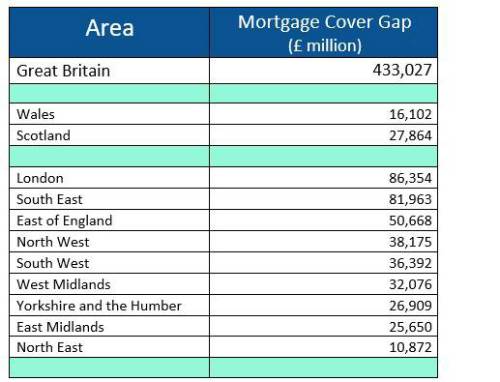

To understand what proportion of the nation is not insuring householders’ lives, Beagle Street commissioned analysis from independent research organisation MindMetre. The study calculated the mortgage debt estimate for each region of England, as well as for Wales and Scotland, that is not protected with life insurance. This potential liability for homeowners should their partner die unexpectedly has been christened the ‘Mortgage Cover Gap’.

Beagle Street Associate Marketing and Distribution Director, Beth Tait, said, “With this study, we aimed to give intermediaries the powerful evidence they need to recommend that customers take the critical step of protecting their mortgage. Unexpected death is not something we want to think about, but it’s the responsible thing to do to avoid leaving loved ones in the lurch, especially given excess mortality rates post-COVID. This paper also comprehensively provides government, social scientists and large employers with important perspectives on the issue, so that we can collectively do more to encourage uptake.”

The full report can be downloaded here

|