With most UK adults currently under-saving for retirement, it’s never been more important for people to consider when and how they can top up their pension to maximise their retirement income. Small, regular contributions can build up over time and new analysis from Standard Life, part of Phoenix Group shows how people who are paid overtime could boost their eventual retirement pot by tens of thousands of pounds by putting some of their additional pay into their pension.

Since 2012 all employers have been required to enrol all eligible employees (those over 22 years old and earning over £10,000 a year) into a workplace pension. The current minimum contributions are 8% of an employee’s salary – 5% from the employee, and 3% from the employer. However, this usually discounts extra pay like bonuses and overtime. Some industries, like manufacturing and construction, routinely offer paid overtime at typically 1.5x the normal rate of pay, potentially creating a sizeable extra pool of earnings to dip into.

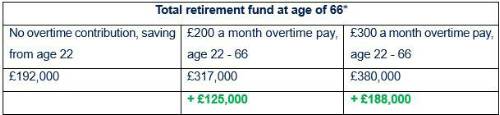

Standard Life analysis finds that someone who began working full-time with a salary of £25,000 a year and paid the minimum monthly AE contributions from the age of 22, could have a total retirement fund of £192,000 by the age of 66, allowing for 2% inflation over the period. However, someone who chose to contribute just £200 of overtime pay a month for the duration of their career on top of minimum contributions could build up as much as £317,000 by the age of 66 – £125,000 more. Someone who chose to contribute an additional £300 of overtime pay a month could potentially end up with an even bigger pot of £380,000 in today’s prices.

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures allow for 2% inflation. Annual Management Charge of 0.75% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

The calculations show that even a relatively modest extra pension contribution from overtime pay can make a significant difference in time, thanks to the power of compound investment growth.

Gail Izat, Managing Director for Workplace Pensions at Standard Life said: “While putting the minimum required into your workplace pension is a great way to start saving, for most people auto-enrolment minimums aren’t high enough to secure a decent standard of living in retirement. The best way to consistently boost your pot is to increase contributions from your basic pay, however if you’re struggling to manage the trade-off between long and short-term financial priorities contributing from overtime pay instead could make a real difference. People often underestimate the power of small, consistent savings over time and a little bit extra now can have a real positive impact on your future standard of living.

“Pensions are also incredibly tax efficient, so contributing overtime pay into a pension is also a great way of maximising the percentage of your pay you get to keep. This can be particularly valuable if overtime pay pushes you into a higher tax band. If in doubt, speak to your employer or pension provider.”

|