• 12% of the UK population are on track for retirement, up from 7% in April 2015

• A quarter (24%) have checked retirement savings performance within last six months, up from 19% a year ago

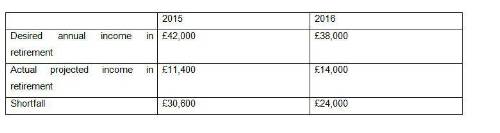

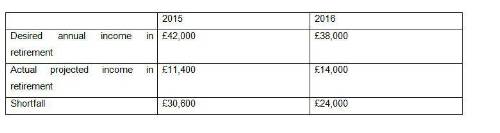

• Gap between desired retirement income and projected income has fallen by £6,600 in the past year

• New Government initiatives mustn’t be allowed to damage progress

One of the key drivers behind the change has been that people have become more realistic about the level of retirement income they are likely to receive. Average annual income expectations have fallen from £42,000 in April 2015, to £38,000. This, coupled with the 15% of the UK population who are saving more into their retirement pot as a direct result of the pension freedoms, means the gap between the income people would like and the income they are set to receive has narrowed by £6,600 in the last year, although there is still a huge gap of £24,000 to address.

People are also engaging more with their pension savings, perhaps also helped by the move away from defined benefit to defined contribution schemes. A quarter (24%) have checked the performance of their retirement savings within the last six months, while over a fifth (22%) have taken steps to review their plans for retirement. This is up from 19% and 18% respectively in April 2015, with government initiatives also appearing to be improving overall engagement.

Steven Cameron, Pensions Director at Aegon UK, comments: “We’re seeing a seismic shift in attitudes towards saving for later years, with 12% of the population now on track for the retirement they want. Across the UK, this means 2 million people have improved their saving behaviour, or changed their aspirations for retirement.

“As we enter an era of personal responsibility for retirement saving, it’s clear that the pensions penny is finally beginning to drop for the UK’s retirement savers.

“The range of radical government pension changes has certainly grabbed public attention. And it’s heartening to see people being motivated to engage with their future and meet the challenge of funding and planning for their retirement.

“But the job is far from done. 88% of the population are still falling short of their retirement targets. At this critical juncture, the industry and government need to band together to ensure that consumer confusion doesn’t creep back in. This means ensuring that new initiatives, such as the Lifetime ISA and the secondary annuity market, are clearly articulated, and don’t detract from the progress that auto enrolment, and the pension freedoms have already made. Only then will the UK continue to thrive in their planning for later life.”

Aegon report 'Aegon UK Readiness Report' can be found here

|