New analysis of government figures by Standard Life, part of Phoenix Group, highlights that the average retired couple has a pension income worth £284 per week – made up of both occupational and private pension income and excluding state pension income.

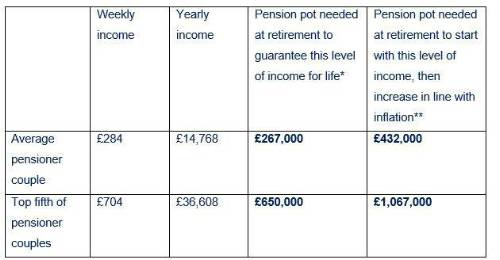

For those approaching retirement who have a similar weekly income target in mind, to buy a ‘level’ annuity which would guarantee this income for life, but might not maintain purchasing power for future years, they would need to have amassed £267,000 in retirement savings. Meanwhile, the top fifth of pensioner couples have pension incomes of £704 per week, requiring a savings pot of £660,000 to secure the same type of annuity and guarantee their income for life. To buy an ‘index-linked’ annuity, which increases income in line with inflation, the required pot is considerably larger, however this provides an income that is more likely to keep up with cost increases.

The analysis comes as annuity rates are however rising. Standard Life estimates rates have improved by 25% since the start of the year meaning that savers can generate larger incomes from their savings.

Retirement Savings to Secure an Annuity- guaranteeing Income for Life:

*Figures assume retirement at the age of 65 – with pension income made up of occupational and private pension income, and excluding the state pension (Figures are obtained by calculating the amount of money needed to buy an annuity that would provide a guaranteed income equivalent to each pensioner income level – using the Money Helper annuity tool)

** Figures assume retirement at the age of 65 – with pension income made up of occupational and private pension income, and excluding the state pension (Figures are obtained by calculating the amount of money needed to buy an annuity that would provide a guaranteed income equivalent to each pensioner income level – using the Money Helper annuity tool). Inflation measure is RPI.

Standard Life’s analysis also found that over the last ten years, the average income of retired couples has increased by around 7% in real terms, with the richest fifth increasing by 4%, compared to 7% for the least well-off pensioners.

Jenny Holt, Managing Director for Customer Savings and Investments at Standard Life said: “Thinking about the amount of money you need to retire can be daunting, but it’s important to have a savings target in mind to fit your desired lifestyle in retirement, that you can work towards. The Retirement Living Standards tool from the Pensions and Lifetime Savings Association is a great place to start, clearly showing what life in retirement looks like at three different levels - Minimum, Moderate and Comfortable. As well as everyday costs, the tool factors in what’s needed for extras- gifts, holidays and large purchases etc., as well as the one-off expenses that come up through life. It’s also worth keeping in mind that any personal savings are likely be topped up by the state pension and those with 35 years of qualifying National Insurance contributions can currently expect around £9,600 a year under the new state pension.

“It is encouraging that over the past ten years pensioners incomes have increased in real terms. However, in the current environment with inflation having recently reached double figures, there is an increased challenge of making money last. So, even while we are in a challenging situation which can lead to a focus purely on short-term finances, if you’re able to continue paying attention to your long-term pension savings, it will be extremely worthwhile by the time you come to retire.”

Standard Life offers tips to help you make your savings work harder during this difficult inflationary period:

1. Revisit your financial goals – As you start to notice the effects of increased prices, you might find that your current financial goals could take longer to reach than originally planned, or they might need to be adjusted. So now could be a prime time to revisit your plans and consider if they need to change.

2. Pay Your Pension Some Attention – take advantage of this nationwide campaign designed to help people better understand their pensions by accessing a range of free online support and guidance from now until November: https://pay-your-pension-some-attention.mailchimpsites.com/

3. Have a direct debit detox – Many of us rack up memberships and subscriptions that we could probably live without, so have a think whether you could cancel them or shop around for a better deal. You might be surprised at how much money you could save.

4. Prioritise your spending – Whilst times are tough, it’s worth seeing if you can put off purchases you’d planned for a while longer. If it’s not essential, you might be better waiting until you’re confident that making that purchase now won’t impact your standard of living. However, if you’ve been thinking about making a big purchase, such as a car or a required home improvement and you have the money to do so, you might find you’d be better off going ahead now rather than waiting until later when prices could be even higher and the pound in your pocket is worth less, saving you money in the long run.

5. Try to clear any outstanding debt - When inflation rises, interest rates are generally increased to help control the economy. If you have any variable rate debt, you might find that your regular payments go up as a result. So, it’s best to review debt arrangements as a priority, making sure you are reducing interest being paid as much as possible.

6. Make the most of tax efficient savings, and consider making investments- It’s worth bearing in mind that you get tax benefits on pension payments, effectively meaning it costs less to save more into a pension plan. So even if you’re focussed on short-term finances at the moment, it’s important to continue contributing to your pension: time in market is one of the most important factors in investing, and if you choose to stop contributing you may miss out on valuable contributions from your employer. Although remember that you can’t access your pension savings until you’re aged 55 (rising to 57 in 2028). If you want to access your money before 55, while giving your savings the opportunity to grow in line with inflation (and, importantly, stand a chance of beating it), one of the best ways to do this is to invest over the medium to long term, which is generally five years or more. Stocks & Shares ISAs are a great, tax-efficient way to save for medium or long-term goals without having to tie up your money. Or you could consider a Cash ISA for shorter-term goals like rainy day funds- but, of course, be mindful of the impact of inflation on the value of these. For more information on this, you can speak to your bank or provider, or visit the government’s free Money Helper service.

|