The study reveals fewer than one in three people (28%) feel secure in their knowledge of how to manage their pension as they get closer to retiring. Just 27% are confident they know what a ‘good’ amount is to have in their pension for someone their age.

Women are almost twice as likely as men to feel completely ‘on the back foot’ (21% versus 12%) with preparing and saving for retirement. They are also more than twice as likely as men to be in the dark about how to manage their pension as they get closer to retirement (34% vs. 14%).

More than two in five pushing retirement to the back of their minds

The findings come despite nearly ten years of auto-enrolment encouraging more people to save via the workplace, backed by guidance services like PensionWise to help them understand their pension options. But Aviva’s research shows accelerating change and ambiguity have left many people confused about their future.

The number of people in work who say they know how much they need to save for retirement has dropped sharply since before the pandemic, from 61% in February 2020 to 52% now. More than two in five (42%) admit they have not even started thinking about retirement yet, including 39% of workers in ‘Gen X’ aged 40-54 who have put any thought of retirement to the back of their minds.

As a result, nearly three in four of ‘Gen X’ (74%) feel like they will have to work much longer until they retire, rising to 79% of ‘Gen Y’ aged 25 to 39.

Workers looking for employers to help their transition into retirement

Aviva’s research pinpoints the workplace as a key battleground in the national effort to address the retirement savings gap.

It shows nearly three in five (59%) employees would be open to receiving pension planning support at work to help them identify how much they need to pay into their pension to live well once they retire. Almost one in four (23%) adults would like to be offered support on how to manage their pension as they approach retirement, while one in five (20%) would like more support on what type of pensions there are.

More than half (51%) also believe they will need support from their employer to create an easier transition into retirement, such as flexible or part-time working. Two in five (41%) are worried about being able to retire when they want to – significantly more than the 31% who are worried about how much they currently get paid.

Mary Harper, Managing Director of Aviva Financial Advice, comments: “It’s very easy to put thoughts about later life to the back of your mind, but investing time in thinking and planning ahead can make a world of difference to your options. Although you may have to pay for it, evidence suggests that people who access financial advice are, on average, tens of thousands of pounds better off in the long-term¹, but it’s not always something people feel they can relate to, benefit from or feel is designed for people like them.

“However, whether people are working longer out of choice or necessity, many are crying out for greater help from their employers to help them manage their finances ahead of retirement. Auto-enrolment has been a huge success in giving more people access to pensions, but it’s what you do with your pension that really counts.

“It’s important people have sufficient financial knowledge to make the right decisions for them at the right time. Our research shows that employers have a key role to play in filling the pensions preparedness vacuum. Access to a combination of information, guidance and advice via the workplace can help people make the most of their money for the long-term.”

Industry and individual actions required

To help address the issue, Aviva is calling for a Living Pension accreditation to be created – the pension equivalent to the living wage – to help businesses ensure their workplace pension supports a minimum standard of living in retirement.

It also offers the following top tips on ways to help boost your pension pot:

1. Understand where to start: Before you consider your plans for tomorrow you need to understand where you stand today. Look into your current pension statements to determine how much you have saved already and research when you’ll be eligible for the state pension and check how much support you are forecasted to receive.

2. Take advantage of your workplace pension: All employers are legally required to offer a workplace pension for those who meet the auto-enrolment criteria and they are organised automatically when you join a company. They are subject to tax relief, your employer has to top it up by at least 3% of your pensionable earnings and you will never lose it, even if you only stay in the job for a short amount of time. At retirement age, you will want to thank your younger self for opting in and taking control of your money. For those who don’t meet the criteria there may still be options available to you which you can find out more about from your employer.

3. Take advantage of online planning tools: Aviva’s tools give you a good overview of what your retirement income might be based on how much you are currently saving, putting you in the driving seat of your finances.

4. Track down your pension pots: Moving jobs more frequently means amassing more pension pots. It can be hard to keep track of different pots, however the government offers a pension tracing service to help you track down any forgotten pots. You may also be able to combine smaller pensions into one larger pension pot, which may make it easier to manage your investments. You should consider the charges and investment choice offered by the different plans, as well as any valuable or safeguarded benefits that could be lost, in order to decide whether it would be in your best interests to bring them together into one.

5. Find out if your workplace offers support: Our research shows employers have a key role to play so ask whether they offer any education sessions or appointments with financial advisers to help you plan for your future retirement.

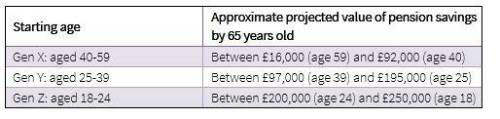

Despite the challenging outlook, Aviva is also encouraging people to recognise it is never too late to save. Based on an average UK salary of £30,000, Aviva’s analysis shows an employee aged 40 today with no savings to date could build a pension pot of about £92,000 by the time they reach age 65, based on the current minimum employee and employer pension contributions under auto-enrolment. This pension pot would provide an income in retirement in addition to the state pension. The value of investments can go down as well as up and employees may get back less than has been paid in.

Source: Aviva UK, 2021. It’s important to note that these figures are based on current rules of tax relief. And based on assumed pension charges (0.75% pa), assumed rates of investment growth (2.4% pa), assumed rates of earnings growth (3.5% pa) and assumed rates of inflation (2% pa) , which are not guaranteed.

Laura Stewart-Smith, Head of Workplace Savings and Retirement at Aviva comments: “Our findings show there is a major vacuum in retirement preparedness which businesses can help to fill. We’ve seen the lines between home and work become blurred beyond recognition for many people during the pandemic. As we look ahead to the future, employers will play a key role in helping people to manage their workplace pension to their best advantage.

“We are calling for a Living Pension accreditation to help give people confidence that they work for an employer who will help provide for their future wellbeing, as well as their immediate needs. When it comes to saving, you need to understand where you’re starting from, where you want to get to and the actions you need to take to get there. A more personal approach to financial education at work can give more people the opportunity and support they need to take positive steps to improve their financial wellbeing.”

|