Compared to the previous purpose of showing trends and reflecting underfunding risk to the PPF, the new way of calculating the assets and liabilities means they may now be viewed as an estimate of the values of these items in the universe at a moment in time. The impacts of these updates as at 31 March 2024 (the effective date of the Purple Book 2024) are set out in the table below. The Purple Book 2024 includes further detail.

December update (at 30 November 2024)

This update provides the latest estimated funding position, based on adjusting the scheme valuation data supplied to The Pensions Regulator as part of the schemes’ annual scheme returns, on a section 179 (s179) basis, for the defined benefit pension schemes potentially eligible for entry to the Pension Protection Fund (PPF). A scheme’s s179 liabilities represent, broadly speaking, the premium that would have to be paid to an insurance company to take on the payment of PPF levels of compensation. This compensation may be lower than full scheme benefits.

Highlights

Shalin Bhagwan, PPF Chief Actuary said:

Shalin Bhagwan, PPF Chief Actuary said: “We’ve made some significant changes to how we calculate the scheme funding data for this year’s Purple Book, which consequently impacts the figures we report through the 7800 index. This is something that we were asked to look at by industry and by the Work and Pensions Committee, and has become possible, in part, because TPR now require more granular asset allocation data in their annual scheme returns. As a result of this, we have been able to enhance our roll-forward calculation methodology and improve the quality of the data that we report. Although this has led to a downward revision in the estimated aggregate funding position of the universe, the overall outlook for DB schemes is still very encouraging – ten years ago the estimated buy-out funding level was 62 per cent, now it sits at 94 per cent. On top of this, 2023 was a record year for risk transfer deals, with £60bn worth going through, and this positive trend has continued through 2024. So despite these revisions, the most important takeaway is that the DB universe is in good health.”

James Emmott, Actuary said: “Every year, following the publication of the Purple Book, we align the dataset we use for the PPF 7800 index with the data in the Purple Book. Doing this means we have a more up-to-date picture of the schemes we protect and helps us to better understand the risks we face. In addition to the regular update, we have introduced a number of refinements to the roll-forward calculation methodology used to estimate the asset and liability figures in the Purple Book and 7800. For example, we can now use more granular asset allocation data collected in annual scheme returns by the Pensions Regulator (TPR), applying a wider range of relevant market indices in our asset roll-forward calculations. In addition, where previously we did not take account of cashflows in and out of schemes – particularly benefit payments – our calculations now include estimates of these.

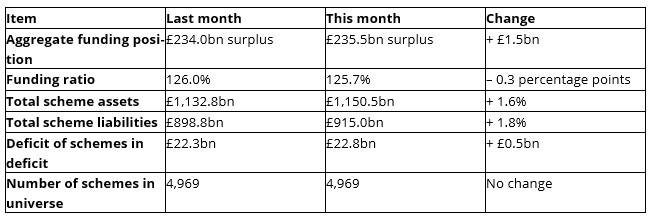

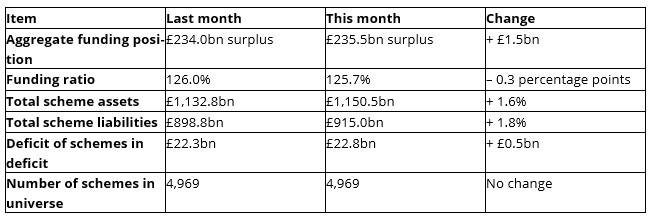

“These refinements have led to some significant changes in the data we are able to produce and this can be seen in the estimated aggregate funding position of the universe. Using the previous dataset – from Purple Book 2023 – and the old methodology, the estimated aggregate funding position grew from a surplus of £359bn at 31 March 2023 to £456bn at 31 March 2024. With the new, enhanced dataset and methodology, the estimated surplus starts at a lower base and grew less, from £207bn to £219bn, over the same period. Using the latest data and our new roll-forward method, in the last month we have seen a small increase in the estimated aggregate surplus of schemes, by £1.5bn to £235.5bn, although the estimated funding ratio experienced a very slight drop of 0.3 percentage points to 125.7 per cent. The improvement in schemes’ funding position was caused by a 1.6 per cent increase in total scheme assets over the month to £1,150.5 billion, not completely offset by a 1.8 per cent increase in total scheme liabilities, to £915.0 billion. The liability and asset increases have come from bond yields going down and equity indices going up over November. Meanwhile, the deficit of schemes in deficit rose by £0.5bn to £22.8bn.”

View the December update and see the supporting data on the 7800 Index for 30 November 2024 here:

The PPF 7800 index | Pension Protection Fund