By Alex White, Head of ALM Research, Redington

They can be the best of both worlds, offering hedging with a secured, contractual return pickup, and can be ideal in a CDI context.

So, what’s the catch? There are a few reasons why a pension scheme might not want to invest in this type of asset. In this piece, I’ll focus on long leases as an example, but the principles extend to other, similar asset classes.

Firstly, a well-funded scheme might not need to invest in illiquid assets. They add complexity and require more governance, which may well be an unnecessary burden.

Secondly, while insurers may hold similar assets, these assets may well not be buy-out friendly and insurers may well prefer cash or liquid instruments. This can be because they are illiquid, so hard to price and hard to sell. They will also require far more due diligence on the insurer’s part, require a longer lock-in period and will make the buy-out process slower. Or it could be the exact holdings may not tie in well with that specific insurer’s matching adjustment.

Furthermore, insurers largely operate in primary markets for these assets and even though an insurer may still be the highest bidder for an asset, it may not be same insurer who offers the best overall price.

Thirdly, they are illiquid, so any investor loses the ability to trade tactically. This may well not be too big a problem but the ability to cut allocations when spreads are low and increase them when spreads are high can add value.

Fourthly, there is a lag between deciding to implement and getting money in the ground, generally a few months.

Markets can move quickly and an asset can offer an attractive pickup over corporate bonds at the point of decision, yet be more expensive by the point of purchase

Finally, illiquid assets can complicate a scheme’s hedge. They provide cashflows, so not including them in the hedge calculation is likely to result in an over-hedge.

However, this leads to complications.

In many ways, long leases can be viewed as bonds that don’t price like bonds – this means they don’t offer mark-to-market protection. An instrument offering stable cashflows over 20-25 years might have a duration of 8-10 years.

However, a lease portfolio is unlikely to gain 10% if rates fall by 100 basis points, simply because they price much more in line with property markets.

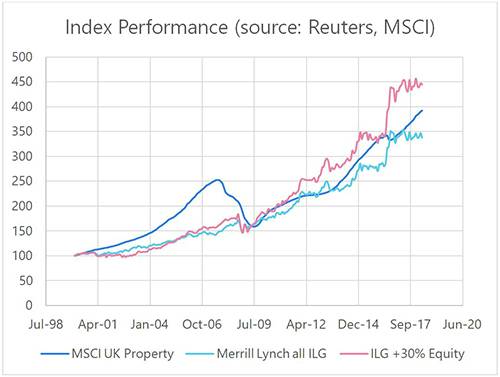

That may not seem relevant if the assets are simply held to maturity. However, there is still a risk that the assets fail to do what they were bought for, and we’ve seen this risk realised. Historically, these assets have generally performed well in absolute terms, but have had much more disappointing performance when accounting for the performance of a simple gilt or linker hedge. A scheme with a lease portfolio as part of its hedge would have enjoyed the performance of the assets, but would have held a smaller gilt hedge, and would have lost out accordingly. That means the performance can look positive, even while the asset has hindered the portfolio. The graph below shows this, proxying lease performance with the MSCI UK property index, and comparing it to the ML All Index-Linked Gilt index (G0LI). We also show the performance of a portfolio combinging a hedge with similar risk growth assets. The hedge-adjusted performance has been much lower than the outright performance.

In summary, these assets can be a very natural fit for pension schemes and can be a very useful part of a portfolio. But they are not magic bullets and will not be appropriate investments for every scheme. If they are intended to provide both growth and hedging characteristics, it is also important to judge their performance against both goals.

|