Government data has highlighted the radically different retirement prospects of homeowners and renters, illuminating the vast wealth disparities among the two groups in the UK and exposes the soft underbelly of auto-enrolment, according to Damon Hopkins at Broadstone, a leading independent pensions and benefits consultancy.

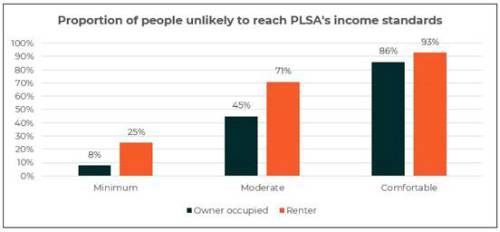

The research shows that a quarter of renters are unlikely to achieve even the PLSA’s definition of a minimum income standard of £12,800 p.a. in retirement – more than three times the proportion of homeowners (8%) in the UK.

As expected, the gap is even wider when it comes to achieving a moderate income standard (£23,300) with 71% of renters unlikely to reach this level compared to 45% of homeowners.

It is not only homeowners and renters where the government research exposed huge divisions. For example, single people (19%) are more than twice as likely to not achieve a minimum income standard compared to couples (8%).

Interestingly, a higher proportion (14%) of those set to reach State Pension Age in this decade are unlikely to meet the minimum income standard than any other cohort.

While the research indicates a pressing need for support for the millions of people set to enter retirement with inadequate savings, it also demonstrates the need for firm intervention to help deliver better outcomes for the tens of millions of people set to reach later-life beyond 2030.

Damon Hopkins, Head of DC Workplace Savings at Broadstone, said the figures highlighted the substantial work still to be done to ensure the success of increasing pension membership via auto-enrolment translated into adequate retirement outcomes.

“Despite the vast increase to pension scheme membership which is now nigh-on ubiquitous among employed workers in the UK, more needs to be done to ensure many groups are saving sufficiently ahead of retirement,” he said.

“The gap between homeowners and renters is a stark reminder of the wider financial benefits that homeownership can bring, as well as the difficulties that those struggling to get on the housing ladder face.

“With many renters trying to save up to get on the housing ladder while paying rental prices that have surged since the pandemic, it is unsurprising that pension contributions may slip further down the order of priority.

“The cultural and financial importance placed on property ownership has not only boosted prices further but meant that for many people other financial goals are compromised. It clearly points to the improvements needed in the auto-enrolment system which go beyond the homeowner versus renter dichotomy.

“Average DC savings rates are likely to fall well short of ensuring many people live the comfortable retirement that, in many cases, they expect.

“The Government’s proposals to extend auto-enrolment rules by reducing the minimum age to 18 and removing the lower earnings limit are small steps in the right direction but mandating higher pension contributions has to be an urgent priority.

“We also need better governance around investment strategies to ensure that the hard-earned money people are putting into pensions is performing for their later-life. Other initiatives like improving financial education (in all aspects of society i.e. school, work, social media etc) will further help people recognise the importance of accumulating adequate later-life savings.”

|