Nicholas Hyett, Investment Manager at Wealth Club, comments: “The tax burden is at the highest level in decades. No-one likes to pay more taxes, something the government is very well aware of. That’s why we’re seeing a steady increase in so called stealth taxes. Taxes that increase your bill without needing a change to existing rules.

At first glance ISAs seem to have escaped the taxman’s attention in the recent round of hikes. However, the reality is that the UK’s favourite savings and investment accounts are falling victim to these stealth taxes; the same approach that’s pushing more and more people into higher rates of income tax.

ISA rules may not have changed, but their ability to shelter your money from the taxman has. That’s thanks to interest rates, inheritance tax and inflation.”

1. Interest Rates

“Higher interest rates are good news for our cash savings, but they also risk the tax man dipping his fingers into your rainy day fund in a way he wouldn’t have in the past – particularly as frozen tax thresholds increase the number of higher or additional rate taxpayers.

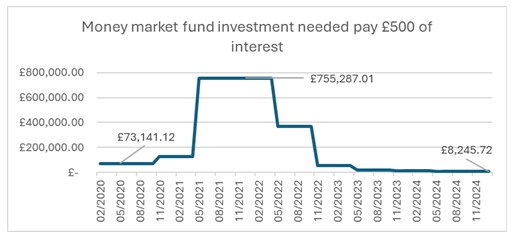

The graph below shows the amount of money you would need to save into a cash fund to earn £500 in interest. £500 is the annual savings allowance for higher rate earnings, after which you need to start paying tax. Before the pandemic, when interest rates were lower, you could save over £70,000 into a cash fund before you needed to worry about paying the taxman. That spiked even higher during the pandemic, when interest rates were cut to near zero. Now rates have risen, taxpayers could find themselves in the taxman’s sights with savings of as little as £10,000.

Cash ISAs have gone from a nice to have to absolutely crucial, even for those with relatively small savings pots.

The situation isn’t helped by the fact many of these taxpayers probably haven’t filled out self-assessment tax returns in the past – since the chances are they’re paid by PAYE. Taxpayers could find themselves in a position of having to go through the administrative headache of a tax return to declare only a few pounds of interest income.”

Source: Morningstar, 27/02/25, Royal London Short Term Monet Market Fund

2. Inheritance tax

“ISAs are tax efficient in many ways, but they have always been liable to inheritance tax.

The decision to make pensions liable to inheritance tax, is likely to increase the number of ISA investors that face IHT bills – since the proportion of estates that are liable for IHT has increased dramatically. Historically one solution was to invest in qualifying AIM companies. Investors backing these smaller UK businesses were given inheritance tax relief as a way to increase the funding available to younger UK businesses and encourage them to list in the UK. Unfortunately, IHT relief on AIM shares was cut at the budget – from 100% to 50%. There is now effectively no way to mitigate an ISA IHT liability completely.

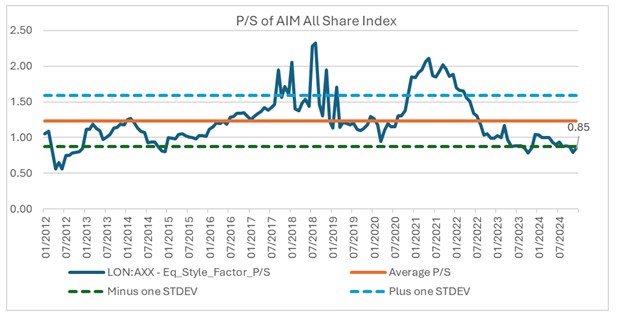

However, AIM companies could still be attractive. Not only do they continue to deliver some IHT relief, but after a very poor run means AIM valuations are exceptionally low by historic standards. The graph below shows the price-to-sales ratio of the AIM all-share. At 0.85 it is currently well below its long term average, and historically returns from this valuation have been in the region of 34% over the next five years – although of course this is not guaranteed and past performance is not a guide to future returns.

Source: Morningstar, 27/02/25

3. Inflation

“The ISA allowance has now been unchanged since 2017. We’ve seen considerable inflation over that period, and as a result the real terms value of the £20,000 a year allowance has fallen by around 25%.

In 2021/22, the most recently available figures, around 16.9% of ISA subscribers contributed the full £20,000. This is only likely to rise, and that means more cash or investments will be left outside an ISA and become liable to tax.

We think this is one of the reasons behind the rise in popularity of venture capital schemes like Venture Capital Trusts (VCTs) and the Enterprise Investment Scheme (EIS).

While higher risk than more conventional investments, both schemes offer tax relief upfront of 30% with tax free capital gains, while VCTs also pay tax free dividends. All of that is appealing in an environment where conventional investments face ever higher rates of tax.”

|