The IMA offered its latest contribution to the debate with its response to the European Commission's Green Paper on corporate governance.

Much of the Green Paper puts forward sensible proposals for ensuring good governance in European companies and positive engagement with shareholders. But a section about shareholders raises some broader issues, talking about "inappropriate short-termism among investors" and asserting that the agency relationship between asset managers and asset owners "contributes to capital markets' increasing short-termism and to mis-pricing".

The only quantitative evidence offered for this is that stock market turnover is now 150%, which, after a quick piece of mental arithmetic, implies that investors are holding stocks for an average period of only 8 months. If that were true it would indeed be worrying - I for one would certainly not be happy if I learned that's how the manager of my pension savings was behaving.

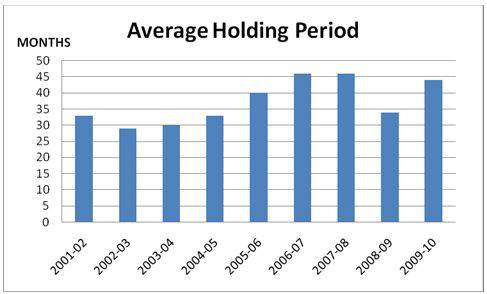

Thankfully it isn't. Analysis of market turnover demonstrates that a good three quarters of that turnover is down to hedge funds and high frequency traders, not traditional investment managers. And there is other data which sheds light on the position, including HMRC's figures for stamp duty receipts. If you take the receipts from the 0.5% charge on share trades, and divide by total market capitalisation, you get a figure for share turnover and hence implied average holding period. Here is the result:

So over the last ten years there seems to have been no discernible move to shorter holding periods - indeed the numbers are if anything a little higher at the end of the decade than at the beginning. And where turnover does increase this is unsurprisingly during the highly turbulent times of the dot.com crash from 2001 to 2003, and the credit crunch in 2008 and 2009. That apart, holding periods are pretty steady at around 3-4 years. And that of course doesn't mean that managers only stay invested in companies for that length of time: a lot of turnover is because of investors coming in and out of the fund, or decisions by the manager to increase or reduce holdings, rather than to sell up and walk away.

The Department for Business, Innovation and Skills has asked Professor John Kay to carry out a review of the impact of equity markets on business. That will be an opportunity to give all these issues a proper and rigorous airing. John Kay is a first-class economist, and just the sort of person to dispel the myths which plague this area. I'm looking forward to engaging with him.

Richard Saunders

Chief Executive, IMA

|