The average debt hidden from a partner in the UK is £8,293, which would take approximately 15 weeks for the average Brit to pay off, even if they could commit their entire earnings to clearing this debt.

In fact, over 460,000 people wouldn’t have even started a relationship with their current partner if they had been aware of their financial position when they started dating.

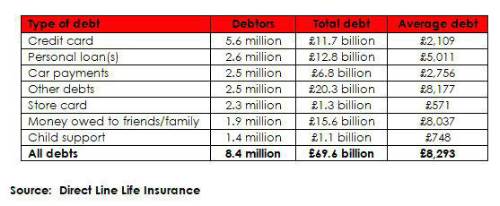

The largest number of hidden debts are on credit cards with 5.6 million Brits owing an average of £2,109, or cumulatively £11.7 billion, their partner doesn’t know about. The other debts mostly likely to be hidden are personal loans, which 2.6 million Brits haven’t told their partner about and car payments (2.5 million). In a move likely to cause huge acrimony if it were ever to be revealed, 1.4 million Brits have outstanding child support payments they have hidden from their current partner, at an average of £748.

Table one: Types of debt for people in the UK

Brits justify hiding debts from their partner, with 29 per cent of those in this position claiming they are trying to pay off the money owed so don’t need to tell them. Nearly one and a half million Brits (17 per cent) say they hide the money they owe to avoid arguments, while more than one in ten (12 per cent) don’t think it is any of their partner’s business.

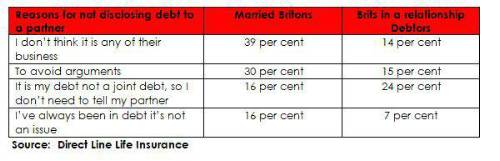

Married Brits who have hidden debts are even more likely to not disclose debts (30 per cent) to avoid arguments, with 38 per cent saying they don’t think it is any of their partner’s business. For six per cent of married Brits who have hidden debts, it is the fear their partner would leave them if they revealed their debt shame leading them to keep it under wraps, even though they would also be liable for the debt.

Table two: Reasons for not disclosing debt

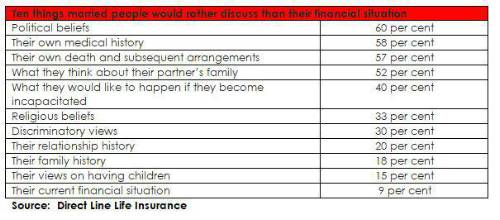

The research also reveals that married Brits are extremely uncomfortable discussing their finances with their spouse. Married people said they would rather discuss their political beliefs (61 per cent) and even their ‘discriminatory views’ (30 per cent) than their current financial situation.

Table three: Topics married Brits use to avoid a conversation about finances

Jane Morgan, Business Manager at Direct Line Life Insurance, commented: “A conversation about your finances can be awkward and if you’ve got debt even somewhat distressing, but it’s important to ensure your partner is aware of your financial position, especially if you live together or are married, as they could be liable for any outstanding debts.

“Given so many people are hiding debts from their nearest and dearest, we’d suggest having these discussions as early as possible to make sure you are prepared. When considering life insurance, couples can build in mortgage costs, as well as a lump sum or any debts to reduce the financial pressure you could face in the unfortunate event your partner passes away.”

Mike W, (anonymous case study) from Kent said: “Money and debt is probably the one thing my wife and I don’t talk about. My wife is more responsible with money than me, so each month I let her handle the finances and keep a little extra aside for myself. I have a £300 overdraft, but as soon as it’s gone I end up putting things on my credit card. A drink here, meals out, a cinema trip, it just creeps up on you. I’ve racked up over £1,000 worth of debt. My wife doesn’t know or she’d be up all night worrying if she did.

"I keep a better eye on it now, but a few years ago I was in about £8,000 worth of debt. I’d lie in bed thinking about it, but we’d just had our son at the time and that comes with so many extra costs that quickly add up."

• British adults are hiding a collective £69.6 billion from their partners

• 16 per cent of Brits in a relationship have debts their partner is unaware of

• The average hidden debt is £8,292.91

• Over 460,000 people wouldn’t have started a relationship with their current partner if they had been aware of their financial position

|