By Alex White, Head of ALM Research at Redington

For example, holding to maturity may not be as easy as it seems if a large proportion of the portfolio is downgraded to high yield over the life of the bond. Even if you can hold it to maturity, that may be no panacea either. While a portfolio can make a lot of money from mark-to-market moves, a bond portfolio held to maturity has a capped upside (the maximum return is the initial spread), with a potentially very nasty downside in the extreme tail (as seen in asset-backed securities during 2008-9).

It may be worth thinking more theoretically. When held to maturity, a bond is effectively equivalent to selling a put option. You have a fixed upside in most scenarios, with a small chance of losing very heavily. The analogue is most pronounced for investors who strip out the interest rate risk – such as pension funds who use the interest rate sensitivity of bonds as part of their hedge – but for other investors, we can think of an equivalent portfolio of puts and appropriate duration government bonds.

Despite their theoretical equivalence, the investments feel very different. Selling puts feels high-risk, whereas IG bonds feel safe. As long as the bonds don’t default, any losses in a downturn will be earned back in the subsequent recovery. Yet, this assumes a recovery - in which case, selling puts while the market is low and implied volatility is high should also deliver strong performance.

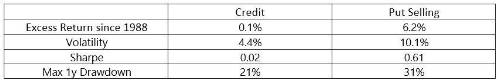

Historically, selling puts has been the better performing option. We compare the CBOE put index (based on the S&P500, sourced from Bloomberg) with the Merrill Lynch US IG all stocks index (sourced from ICE). While this is not quite apples for apples as the underlying indices are based on different stocks, both reflect broad market exposure. Selling puts has performed far better, even with several crises in sample, while IG bonds have struggled to deliver any excess returns over the 33 years.

In current conditions, an ATM 1y put option might be priced at around 8% of the underlying value. With current credit spreads, an IG bond portfolio might be expected to deliver around 1% returns. You might then expect to beat a bond portfolio with, say, a 30% exposure to a put selling strategy and 70% in cash.

This is not to say that put selling is the right investment for most credit investors. For example, there are serious complexity, governance and implementation issues to overcome. What it does challenge, though, is the extent to which we should see IG bonds as low-risk assets, compared to bar-belled portfolios with low exposures to higher returning assets.

|