If you’re planning an action-packed holiday abroad, or maybe even just a relaxed bit of horse riding, the experts at Go.Compare travel insurance warn that you should check you have the right protection in place, as not all activities are covered as standard.

New research from the comparison site has found that travel insurance policies can vary widely in terms of the sports and activities they cover - with some insurers offering more extensive cover, others giving the option to add cover for additional fees, and some not covering specific activities at all.

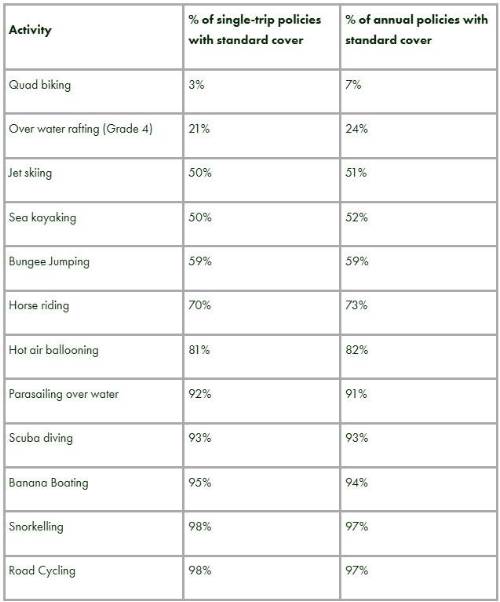

Go.Compare reviewed 892 travel insurance policies and found that only 3% of single-trip policies cover quad biking as standard, and only a fifth (21%) automatically cover white water rafting. Even seemingly lower risk activities weren’t covered as standard in some single-trip policies. For example three out of ten policies (30%) do not cover horse riding as standard and nearly two in ten (19%) do not cover hot air balloon rides as standard.

The research also revealed that a number of activities and sports are covered by fewer insurers this year than they were the previous year - with those covering bungee jumping having dropped 7% since 2023, and those single trip policies covering horse riding down 7%.

Rhys Jones, Go.Compare travel insurance spokesperson, commented: “While you might naturally think of some things - such as white water rafting - as being higher risk than your standard holiday activities, it might come as a surprise to see what your travel insurance will and won’t cover as standard.

“We always recommend checking the specifics of your travel policy before you embark on your trip and planning accordingly, because even if you think your planned activities are low risk, there’s a chance your insurer might think differently.

“Travel insurance can protect you from a wide range of mishaps and unfortunate events, such as cancelled trips, medical costs and lost baggage. However, the research shows there are some risks that aren’t covered as standard, so it’s vital you make sure you have the protection you need in case you need to make a claim. If your standard policy doesn’t quite cut it, remember you may be able to purchase add-ons to cover specific activities you have planned.

“As well as certain activities possibly being outside your travel insurance, it’s worth noting your insurer could have further exclusions too. For instance, some travel policies will have an age cap on certain activities, and others might exclude professional or competition-level sports. Additionally, it’s likely your policy will require you to wear appropriate safety gear, be free from alcohol and other substances, and avoid any reckless behaviour. So, always read your policy documents carefully so you know the limits and rules before you travel.”

|