If you are an employee aged between 22 and state pension age and earn over £10,000 per year, your employer will automatically enrol you into a workplace pension scheme. As of 6th April 2019, the total minimum amount of contribution that must be paid into this is 8% of earnings above £6136, with employees paying 4%, employers paying 3% and the Government adding a top-up of 1%. Since its introduction in 2012, auto-enrolment has been credited with triggering millions to begin saving for retirement.

Individuals have the right to opt out of the scheme, but if they do, their employer is unlikely to keep contributing*. Some individuals choose to opt out from the start but there are others who decide to take a break from contributing if their circumstances change after a few years of paying into a scheme. For those in their mid-20s, financial pressures such as saving for a house deposit or clearing student debt may seem like a tempting option.

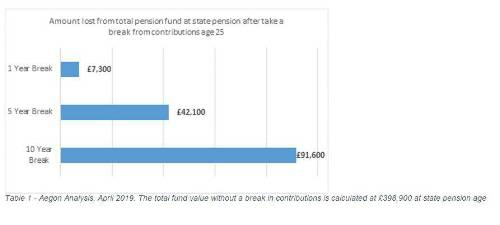

However, even in your mid-20s, the decision to take a break from pension contributions will have significant long-term impact on the value of your pension pot in retirement. In fact, the impact of a break can be more the younger you are as you’re losing out on a longer period of investment growth. Analysis by Aegon looked at the potential losses to the total pension fund at state pension age for a 22-year-old joining a workplace pension scheme on an average graduate starting salary of £20k and taking a break from contributing for different periods.

For this employee, the analysis shows that taking a break for just one year at 25 will save the employee £622 from ceasing contributions but could mean losing £7,300 from their total pension fund when they reach state pension age.

For that same worker, a break of five years could see them lose £42,100 at state pension age and a ten year break could see them lose almost a quarter (£91,600) of the total fund value at state pension age. The total fund value without a break in contributions is calculated at £398,900 at state pension age.

Table 1 - Aegon Analysis, April 2019. The total fund value without a break in contributions is calculated at £398,900 at state pension age

Steven Cameron, Pensions Director at Aegon, comments: The recent rise in minimum contribution levels for auto-enrolment may mean some employees are contemplating taking a break from contributing into their workplace pension scheme. The temptation may be particularly strong for younger workers, many of which will be paying off student debt and saving for a house deposit. Competing demands for money short-term may mean saving for retirement decades into the future is pushed to the bottom of their financial concerns.

“However, opting out of your workplace pension should be avoided wherever possible. While you may increase your take home pay, you’re very likely to lose out on a valuable employer pension contribution. The boost from employer contributions and also the government ‘tax relief’ top-up mean taking a break from contributions effectively means sacrificing ‘free money’. Even a year’s break in your mid-20s could mean losing out on thousands of pounds by the time you reach state pension age.

“Those considering opting out or taking a break should look to see if there are other areas of their lives where they can cut back even if their pension may not feel like a priority. Having gaps in your pension saving history may be something you’ll regret later on in life.”

|