As new research finds that less than one in ten UK adults make occasional lump sum payments into their pension Standard Life, part of Phoenix Group, reveals that those who boost their pension savings with one-off contributions every few years could generate thousands more in retirement savings.

Standard Life’s Retirement Voice report, conducted among 6,000 UK adults, found that only 7% of people make one-off contributions into their pension. However, their analysis shows that paying even small contributions can make a substantial difference to your total retirement pot, as it benefits from compound investment growth over time.

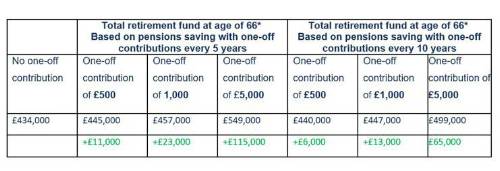

If you began working on a salary of £25,000 per year and pay the minimum monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, you could have a total retirement fund of £434,000 by the age of 66. However, if you were to also top up your pension with nine one-off payments of £500 every 5 years, from the age of 25 to 65, you could find yourself £11,000 better off in retirement. Of course, those in a position to contribute more have the potential to amass a larger retirement fund – for example paying in £5,000 every 5 years, between the ages of 25 to 65, could result in a total pot of £549,000 – £115,000 more than if no additional contributions had been made. These figures are not adjusted for inflation.

Impact of one-off contributions

*if beginning working with a salary of £25,000 per year and paying 5% monthly employee contributions and 3% employer contributions into a workplace pension at the age of 22 and assuming 3.5% salary growth per year. Figures are not reduced to take effect of inflation. Annual Management Charge of 1.00% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

It’s always a trade-off as putting money away means there’s less of it to meet short-term costs or luxuries now, but these figures highlight the potential potency for one-off contributions to build up over a long period of time, particularly when possibly benefiting from the power of compounding.

Gail Izat, Managing Director for Workplace at Standard Life said: “When you come into a bit of extra money, whether it be a bonus, a gift or something else, it’s always tempting to spend it as soon as possible. Right now, lots of people will be using it just to get back on track with monthly bills. However, if you are in a position to do so, topping up your pension can be one of the best ways to look after your future self. Pensions are tax-efficient and have the potential to beat inflation and the interest on cash-based savings, so a small top-up now can lead to a big boost in the future.

“We’re coming towards the time of the year when a lot of people will be expecting their annual bonus, and sacrificing all or part of it into a pension can make a real difference in retirement. Employers and pension providers have a big role to play in conveying the benefits of looking to the future, if at all possible – crucially, showing how pensions are part of a bigger financial picture through targeted communications, as well as giving people the option of seeing all their finances in one place through tools like open finance, can help people stay engaged throughout their lives.”

|