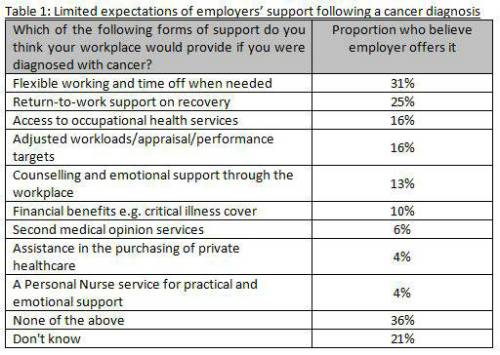

New research finds 36% of employees think they would get no form of support from their employer if diagnosed with cancer – rising to 45% of those who have or have had the disease

Meanwhile one in five (21%) workers have no idea what support their employer offers

Only 31% expect to be granted flexible working if they had cancer, with even fewer anticipating adjusted workloads (16%) or protection benefits (10%)

Two in five (41%) say they would be uncomfortable discussing a cancer diagnosis with their employer or colleagues

Cancer now affects one in two people during their lifetime, and incidence rates among those aged 25-49 have risen by 20% in the past 20 years.1 Despite the growing occurrence of cancer among those of working age, one in five (21%) respondents have no idea if their employer offers any support to those diagnosed with the condition.

Less than a third (31%) of respondents think they would be granted flexible working and time off when needed if diagnosed with cancer, falling to 27% among those who have experienced cancer before. Just 25% think they would be given return-to-work support on recovery, and even fewer anticipate access to occupational health services (16%) or adjusted workloads and performance targets (16%). Only one in ten (10%) think their employer provides financial benefits such as critical illness cover.

UK employees would be uncomfortable approaching their boss or colleagues about cancer

Canada Life’s research also reveals two in five (41%) respondents would be uncomfortable talking to their employer and/or colleagues about a cancer diagnosis, highlighting that many still see a cancer diagnosis as taboo or are worried about the potential outcomes of this conversation.

Over one in ten (13%) say they would be scared to tell their employer about a diagnosis in case they thought they were no longer up to the job, while 18% would feel uncomfortable asking for time off. A sizable portion of respondents would not be willing to tell their colleagues about a diagnosis, with 15% saying they would prefer to keep it to themselves. A similar proportion (17%) would feel awkward discussing cancer with their employer.

Paul Avis, Marketing Director at Canada Life Group Insurance, comments: “The fact that more than a third of people think they would get absolutely no support from their employer if diagnosed with cancer is extremely worrying. Hundreds of thousands of people are diagnosed with cancer each year in the UK2 and it is becoming more common among those of working age. The likelihood of having cancer increases with age and with an ageing workforce, 73%3 of whom have told us they cannot afford to retire, this is a problem that is going to get much worse.

“Cancer treatment can cause many to have to work reduced hours or stop working altogether. Sufferers should be able to make getting better their main priority without worrying about job security and financial stability.

“People who have personally experienced cancer are more sceptical about the support of their employer, which is particularly damning. While many employers might feel they are understanding and accommodating when it comes to cancer, it is clear that more needs to be done in terms of support.

“Benefits such as Group Critical Illness and Group Income Protection cover provide the best help employers can give to staff with cancer. Not only do they provide financial support at a time when household income can be stretched, they also come with a whole host of support services. While our critical illness product provides the practical and emotional support of nurses once a claim is made, both products provide clinical certainty through free access to second medical opinion services. Group Income Protection additionally has an Employee Assistance Programme with counselling and back-to-work rehabilitation, so genuine support is being provided beyond the financial aspects of the benefit. Group risk products are incredibly inexpensive for employers to provide but will mean the world to staff who experience a cancer diagnosis.

“It’s vital that employers with these benefits communicate them properly to staff so they know the depth and breadth of support that can be used.”

|