Auto-enrolment requires employers to set all staff who are aged 22 or older and earn over £10,000 a year up with a workplace pension and has played a key role in helping many millions more save for their retirement. However, new research from Standard Life’s 2023 Retirement Voice survey shows that:

• nearly a quarter (23%) of 18-24-year-olds have never heard of AE

• One in 10 (10%) are only vaguely familiar with it.

• A fifth (20%) of 18-24-year-olds say that they know a lot about AE.

Pension savings are unlikely to be the first financial priority for those entering the workforce for the first time and the research showed that inflation (54%), interest rates (52%) and energy prices (49%) were bigger worries. Low awareness of the scheme was not universal and 42% of the 18-24 group who were familiar with AE believed it be an important stimulant in encouraging people to save.

Young people are set to benefit from upcoming auto-enrolment reform, with a bill to lower the age of eligibility to 18 and remove the lower earnings limit for contributions so people save from the first pound of their earnings now law and awaiting a consultation on its implementation.

Inertia vs engagement

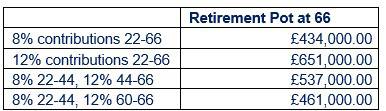

Inertia has been central to the success of auto-enrolment and low levels of engagement may work in the favour of many young people who start saving with minimal input. However, the importance of engagement increases with age and for those in a position to do so, an increase in contributions can be hugely valuable. For example, a 22 year old who starts saving via auto-enrolment may build up a pension of £434,000 by age 66 but those increase their contributions to 12% in their mid-40s are could build a pension of £537,000 – nearly £100,000 more.

Retirement Pot at 66 based on 8% and 12% contribution

*Based on starting salary of 25k at 22 years old. No earnings limits applied. 5% investment growth, 3.5% salary growth per year, 1% investment charge. Not adjusted to take inflation into account.

Are standard contributions enough?

Standard Life’s parent, Phoenix Group has recently published a report to consider the circumstances under which minimum contributions could rise to 12%, which is widely considered to be a more adequate level. As the analysis above highlights, someone who started saving at 22 and paid the minimum AE contributions (5% employee, 3% employer) until retirement 66 could build up a pot of £434,000, not taking inflation into account. However, if they topped up their contributions to the Living Pension target of 12% from 22, they could secure a pot of £651,000 - £217,000 more.

Gail Izat, Managing Director for Workplace Pensions at Standard Life said: “Over a decade on, auto-enrolment has clearly had huge benefits for the UK’s pension savers, helping to fill the gap created by the demise of Defined Benefit schemes and establishing retirement saving as the norm in workplaces across the country. One of the biggest successes of auto-enrolment has been the low level of opt-outs, partly due to the rise of saving by inertia. As people move through their careers, however, the importance of taking an active role in retirement planning increases and lack of engagement can mean people often don’t have the chance to review how much they are saving, review this in the context of what it might mean for their future retirement and adjust their contributions accordingly to meet their retirement goals. In the Autumn Statement the Government announced a consultation into legislating for a pot for life, which would give people the option of choosing a pension that would follow them from job to job. These figures highlight potential challenges with getting people to engage with their savings given low levels of knowledge and the need for careful thought around how we take the system from one based on inertia, to one that would require more active choice from savers.

“There are significant steps currently being taken to increase the amount people are saving into their auto-enrolled pension scheme, including a new law to lower the minimum age to 18 and remove the ‘lower earnings trigger’ of £6,240. However, the single biggest thing that people can do to boost their chances of securing a decent fund for their retirement is raise their contributions as soon as they can to benefit from investment over a longer period.”

|