By Alex White, Head of ALM Research at Redington

The effect is smaller for less extreme payment sizes, but still exists. For instance, with a 4% payment, assets would fall to 46% and would require 117% returns to recover the asset value instead of the 100% that would be needed with no liabilities. Where a scheme is paying a substantial amount of money out in liability payments, the earlier years’ returns are on larger asset values, so poor returns in the early years have an outsized impact on final outcomes.

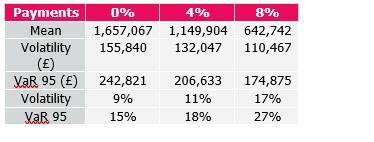

To isolate and quantify this, let’s take a look at some simple cases. These are based on a £1m asset pot with an average of 5% (absolute) returns and 3% volatility across 1,000 simulations. The table below outlines the risks around the final pot values under three scenarios: paying out 0% (£0), 4% (£40,000) and 8% (£80,000) over ten years.

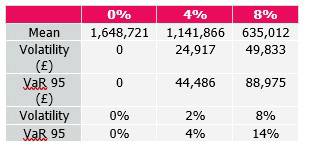

The greater the payments, the smaller the pot and hence the smaller the absolute deviations. However, the relative values increase with the liabilities. This isn’t too intuitive. So below, I’ve outlined a second set of scenarios with exactly the same numbers, only the final year is adjusted such that the asset returns over ten years are identical (at 5%) in each simulation. The only differences are in the route taken to get there. With large payments out, the path of returns can be a meaningful risk.

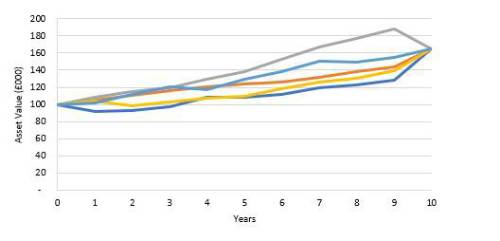

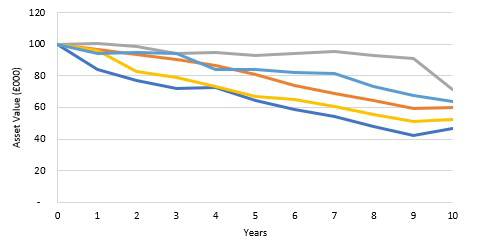

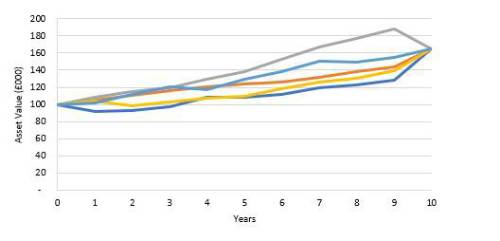

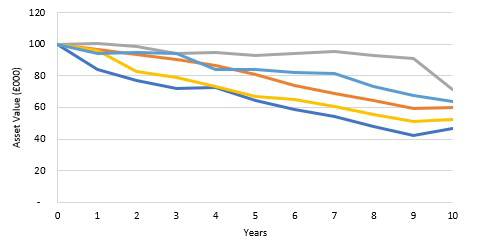

To expand on this point, below we show a handful of random paths with the same overall return to illustrate how the final value can depend on the path of returns. The final pot can be meaningfully different depending on whether assets do well then badly, as is typical of a bubble, or badly then well, as is typical of market crashes.

With no payments

With £80,000 payments p.a.a

With £80,000 payments p.a.a

So that’s sequencing risk. Unfortunately, it’s a mathematical inevitability, so all schemes can do is seek to mitigate it. There’s no silver bullet. However, being aware of it may encourage schemes with substantial outgoings to consider mitigants. Shortening credit duration, for instance, could help as the assets can mean revert more quickly.

Perhaps the best mitigant, though, could be keeping liquidity and bar-belling the strategy with high-returning liquid assets. This could allow the scheme to keep exposure to risk assets more easily, effectively de-risking and re-risking, spreading the risk more effectively over different years.

|