By Riccardo Palma, Head of Index Department, ECPI Group By Riccardo Palma, Head of Index Department, ECPI Group

Age is one fundamental determinant of economic behavior: just think at the life cycle of consumption and investment and to its implications for the macro economy and the financial markets.

At the beginning of their working career, young adults will consume the majority of their income with no money left for saving; after some years they will create a family, buy a house and look after their children. With time, they will start thinking of their retirement and increase savings in risky and non risky assets. Eventually, when retired, they will progressively sell their assets to finance consumption.

In a recent article published on the Financial Analyst Journal ® (Demographic Changes, Financial Markets, and the Economy), Robert Arnott and Denis B. Chaves estimate the historical relationship between demographic age groups and three economic variables, GDP growth, stock returns and bond returns, and find results coherent with the life cycle view summarized in the table below (my interpretation):

According to this view, the impact of an ageing population (increasing relevance of retired group) can be of decreasing GDP growth and decreasing asset values.

A second element to consider is the increasing relevance of the elderly as consumers. For this to work, people must have money to spend either directly, through family links or through the state.

Source: Financial Analyst Journal, “Demographic Changes, Financial Markets, and the Economy”, by Robert Arnott and Denis B. Chaves. ECPI reworking Source: Financial Analyst Journal, “Demographic Changes, Financial Markets, and the Economy”, by Robert Arnott and Denis B. Chaves. ECPI reworking

Over the period, the age groups that gained the most are 55-64 and 65-74 with an increase of 87% and 68% of the average net worth. An important process of wealth creation and accumulation has been working behind the increasing relevance of elderly people as consumers.

Here we have two distinct forces pointing in opposite directions: on one side, the increasing weight of retired people will tend to reduce economic growth as they will not contribute to production anymore; on the other side, the increased consumption potential (wealth) of the very same group will create an additional demand of goods and services.

This is only a schematic view, because the demographic trends bring many challenges to a society and the sustainability of its welfare state, but enough to say it will bring troubles and opportunities.

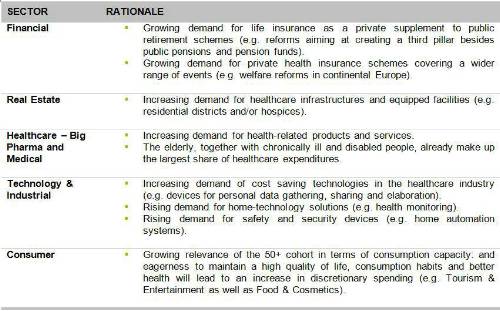

As for the latter, at ECPI we have been working at the selection of sectors and stocks that provide a positive exposure to the demographic trends. The following table schematizes some of the main sectors and the reason:

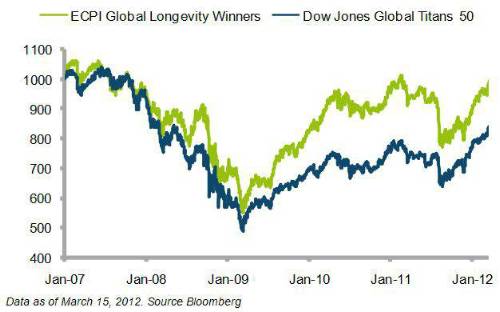

Some of the most liquid companies analyzed were then selected as members of our ECPI Global Longevity Winners Equity Index whose objective is to provide exposure to the global developed markets and to the longevity factor through a liquid and efficient portfolio. The following graph shows a comparison of the index with a comparable global equity index (both indices are constituted by a small selection of multinational companies, respectively 35 and 50).

Over the period going through the crisis, our ECPI Global Longevity Index showed a somehow better performance of -0.75% compared to -15% for the Dow Jones Global Titan 50.

|