New research from Phoenix Group finds 75% of Scots aged between 40 and 66 (pre-state pension age) say they feel unprepared for retirement, equivalent to nearly 1.5 million people. While some of this group have decades to prepare, others will be looking to transition or enter retirement imminently.

Financial worries are overwhelming the driving factor behind this sense of feeling unprepared. Around seven in ten (69%) are concerned they will not have enough savings to fund their retirement.

Under-saving in Scotland – the reality

The research asked over 40s in Scotland to estimate how much they have saved for retirement. Mapping this against industry benchmarks revealed the severity of under saving in Scotland, and the regional differences in the amount people have saved.

According to the PLSA Retirement Living Standards, adults need a minimum of £300k in savings at state pension age to achieve a ‘moderate’ standard of living in retirement – defined as the ability to access a range of opportunities and choices, and have a sense of financial security. Just one in twelve (8%) Scots say they have savings over £300k. In comparison, one in seven (14%) say they have no retirement savings at all.

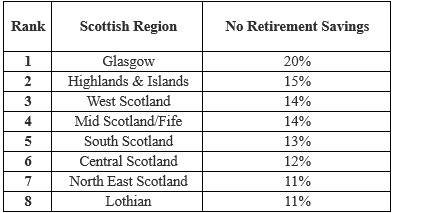

Regional breakdowns show wide saving differences across Scotland, with people in Glasgow reporting the highest level of under saving. Over half (52%) of over 40s in Glasgow say they have under £51k in retirement savings, and a fifth (20%) say they have no retirement savings at all.

Proportion of over 40s in Scotland reporting no retirement savings

Catherine Foot, Director of Phoenix Insights, Phoenix Group’s longevity think tank, comments: “People often have competing priorities when it comes to their money and the cost-of-living pressures in recent years have increased the strain for many. However, it will always be important for people to ensure they don’t overlook their long-term savings and take steps to plan for their future retirement income where they can.

“Often just thinking about your future finances can be the hardest step, but a good place to start is to seek guidance from your pension provider if you have one, or free online services such as MoneyHelper. Without taking action to plan ahead, people are at risk of sleepwalking into retirement short of enough savings to fund it.

“Not everyone will be able to save more, however, so it’s vital there is an adequate financial safety net from the state to support people in the years prior to and beyond state pension age.”

Gail Izat, Managing Director for Workplace Pensions at Standard Life, part of Phoenix Group said: “This research highlights the worrying level of under saving in Scotland and, sadly, we know the situation is similar in the rest of the UK. The fact that a fifth of Glaswegians report no private retirement savings has wider societal implications, particularly as the state pension by itself falls short of even the PLSA’s minimum standard of living in retirement.

“It’s vital that we extend pensions auto-enrolment to bring more people into the scheme and give those who are already eligible a better chance of securing a decent retirement. Last year parliament passed a bill to lower the minimum age to qualify for auto-enrolment from 22 to 18 and abolish the lower earnings limit for contributions. We urge the government to implement these changes as quickly as possible. Longer term, increasing minimum auto-enrolment contributions, when the economic conditions allow, is the single biggest lever we can pull to boost savings adequacy.

Mark Diffley, Founder and Director of the Diffley Partnership, said: “This comprehensive survey reveals that a significant proportion of Scots are unprepared for retirement, with little saved to furnish a decent standard of living in their older years. Women, those in lower social grades, and those in more deprived neighbourhoods are particularly vulnerable, approaching retirement age with significantly less saved than their peers. Such discouraging findings require decision-makers to take notice and action, to ensure that everyone enters retirement with funds to live comfortably.”

|