by John Walbaum, Head of Investment Consultancy, Hymans Robertson

So is the UK State pension unaffordable? We seem to spend much less than our peers on pensions. I believe that we need a serious debate about how we spend the nation’s income. To stop sleepwalking into the future, we need to have it now.

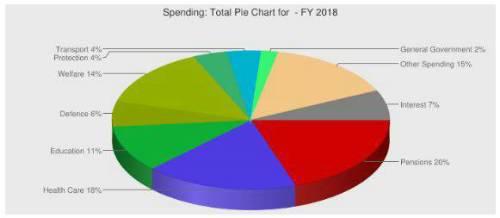

The following chart shows the breakdown of UK spending for fiscal year 2018. UK GDP is £2,030bn and net debt is £1,830bn. Total spending for the year is estimated at £814bn. Pensions are expected to make up 20% of public spending and 7.9% of GDP this year.

One of the issues we face is the level of debt in the UK, currently £1,830bn. This is where the debate about austerity (pay it off asap and restrict public spending to make that happen) and other approaches (such as stimulate growth or pay it off over a longer period) clash. That debate will no doubt run and run, but it has a significant impact on what is available for public spending each year in the future.

So far government has taken the following actions:

increasing the State pension age for all;

introducing auto-enrolment as a means of stimulating more saving;

restricting tax relief for middle and upper earners;

increasing the freedoms in terms of how we can draw our pensions.

Interestingly the last one has led to a huge increase in tax take for the Treasury as people cash in their pensions – there has to be a huge question mark over whether this change is going to exacerbate the long term problems in exchange for a short term cash boost for the public finances.

There are many issues to discuss and I will highlight only 3 of these.

So far the State pension remains a universal benefit at the same level for all. That is a contrast with child benefit which is now means tested and not available to the better off. The debate needs to consider whether or not State pension should be universal in the future.

Another issue that needs to be dealt with is the differences in life expectancy between different groups and how that impacts what they receive. Those in affluent areas with high living standards are now expected to live 20 years longer than those from more deprived areas with lower living standards, so the former will receive the State pension for far longer than the latter. And of course the former are better able to provide for themselves than the latter.

Another issue to consider alongside pensions is long term care and how we look after those in old age who cannot look after themselves. Average costs for residential care are about 1.5 times average earnings, with even the less intensive residential home care being in excess of average earnings. The average cost of care without nursing is around £30k per annum. Last year, average retired household earnings were £27,8001. Those who spend their pension income early, or who do not have enough, will surely fall back on the State in future.

These issues cannot be left to the vagaries of politics. The time horizons of politicians are simply far too short. We urgently need a grown-up debate about the long term financial wellbeing of our people and how we fund it, and that means sensible long term planning. This needs to come out of the political arena, and the conclusions of this debate used to influence all politicians to do the right thing for the long term future of the UK.

1Office for National Statistics article

|