To see if there might be any truth in the old adage, consultants LCP have looked at data from the US “S&P 500” index for the last sixty eight years for which data is readily available. As the chart shows, there may be some evidence of seasonality in investment returns for this period:

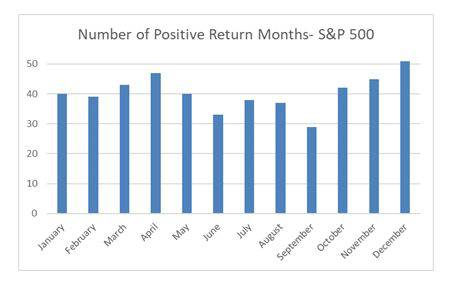

The striking figure from the chart is the typically poor returns in September, especially contrasted with the generally stronger returns in the final quarter of the calendar year. Further analysis shows that June and September are the two months with the fewest instances of positive returns over the same time period – see next chart.

LCP then look at whether this result holds good for different indices such as the FTSE350, in this case for the last twenty years.

This also shows a slightly negative return in September, but, perhaps more strikingly, that this contrasts with generally strong returns on average in the FTSE350 in the final quarter.

The analysis acknowledges that individual years can vary from this average. In particular, in a year like 2022 where there has already been a drop in markets in August, it does not follow that the ‘typical’ drop in September will be seen this year. But based on long-term data, the research suggests that investors looking for an adage might look to replace ‘sell in May and go away’ with ‘“Out in August; Okay by October”.

Further details are in a blog by LCP partner Alex Waite, which is available on request.

Commenting, Alex Waite said: The idea that there might be a seasonal patter to investment returns has been around for a long time, but our new analysis suggests that there might be something in this. Something we see consistently in a long run of US data and more recently in UK data is that September is often a poor month for returns, particularly contrasted with typically stronger returns in the final three months of the year. Whilst we are certainly not encouraging individuals to rush out and sell their investments in the next few days, our results are indicative that there may be something in the idea of seasonality in investment returns which would warrant further research.

|