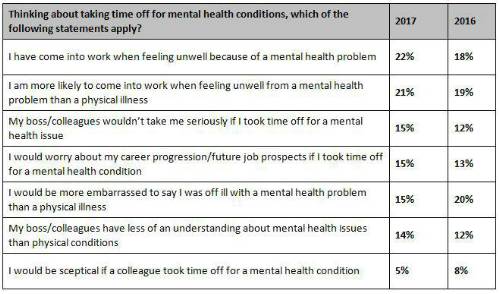

Mental health presenteeism is a growing issue in the UK. Over a fifth (22%) of employees went into work when feeling mentally ill last year, up from 18% in 2016, despite the number of employees not taking a sick day decreasing from 54% in 2016 to 47% in 2017.

A fifth (21%) admit that they are more likely to go into work when feeling unwell from a mental health problem, rather than a physical illness, while 15% state that their boss and colleagues would not take them seriously if they took time off for a mental health issue, an increase from 12% in 2017. Meanwhile, the same proportion (15%) worry that taking time off for a mental illness would jeopardise their opportunities for progression, up slightly from 13% in 2016.

Internal processes may prove to be a stumbling block for employees struggling to take time off when mentally unwell as three in ten (29%) UK employees admit it’s easy to take time off for a physical illness at their workplace, but not for a mental one. Less than half that number (12%) report it is easier to take time off for mental ill health than physical problems.

Lack of awareness for support

One of the main issues concerning mental health issues is the isolating effect it can have on an individual. Over a third (35%) of employees are not currently aware of any form of support their workplace offers to manage sickness absence, while one in eight (13%) definitely do not have any support options available to them.

These issues could be combatted and improved with a more flexible approach to working, a positive attitude towards mental health issues and increased workplace support.

Three in ten (28%) believe flexible working options would help with both their physical and mental health, a similar number of workers (27%) say a more positive workplace attitude towards health and wellbeing would help, while a fifth (19%) think that better workplace support (for example, Employee Assistance Programmes) would be beneficial.

Paul Avis, Marketing Director of Canada Life Group Insurance, comments: “Mental health issues can be a vicious cycle for employees, fuelled by persistent presenteeism and the need to be ‘always on’. Employees suffering from mental illness should be focusing on getting better, rather than struggling into the office, as the stress of work is unlikely to lead to an improvement in their overall condition.

“Despite a noticeable increase in the acceptance of mental health issues in society, employees are still concerned that their boss and colleagues would not take their mental health issues seriously, or worse, that they are hindering themselves for future opportunities at their company by taking time off for a mental illness. Employers must show that they are serious about supporting employees with mental health and stress-related issues. Communicate that it’s fine to take time off to get better and that there won’t be any negative impact on their career for doing so.

“Employee Assistance Programmes are an invaluable form of support for staff with mental health concerns. Back-to-work rehabilitation programmes also support those who need to take a longer period off work. Both of these are provided as part of many Group Income Protection policies. Having these support services in place provides practical support and reinforces the message that employers are serious about employee health and wellbeing.”

|