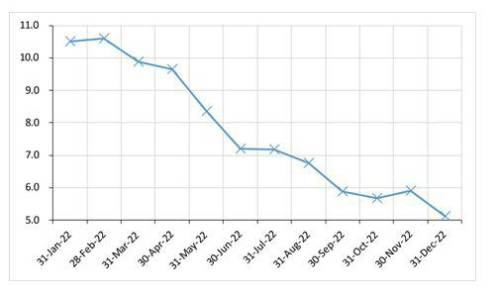

Despite growing economic pressures in 2022, which saw the Bank of England’s intervention in the gilts market to protect pension funds, the trajectory towards buyout for DB pension schemes has remained resilient throughout the year – pointing to the significant improvement in buyout pricing over the year.

Following a slight increase in the average time to buyout from 31st October to 30th November 2022, the index decreased over the month to 31st December, driven by a rise in bond yields causing liability values to fall. This decrease in liability values outweighed the fall in asset values over the month, resulting in improved funding levels.

Simon Taylor, Partner at Barnett Waddingham, said: “2022 was a turbulent year for UK markets to say the least, with the situation in Ukraine, massive political uncertainty, and a volatile gilts market all posing a threat to DB endgame strategies. Despite this, DB pension scheme funding is now in the best position it’s been for a long time – with most FTSE companies now within half a decade from buyout.

“In the face of a national recession and gloomy economic climate in 2023, the pressure is now on for trustees and companies to maintain momentum in relation to their DB endgame strategy as other issues compete for limited management time. Given recent financial market volatility, the strong funding position of the UK’s DB schemes could prove to be transient, so it is crucial for trustees and companies to take advantage of the opportunities currently available. The frenzied bulk annuity market we’re already seeing in 2023 should be warning enough for trustees and companies to get their houses in order before approaching insurers, or they could risk walking away with their tails between their legs.”

|