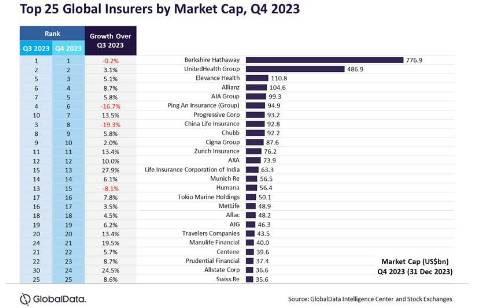

The aggregate market capitalization (MCap) of the top 25 global insurers grew by 2.7% to $2.79 trillion quarter-on-quarter (QoQ) during the fourth quarter (Q4) ended on 31 December 2023. Most of the stocks rose sharply in Q4, benefiting from the increased risk awareness and focus on financial security, according to GlobalData, a leading data analytics and research company.

Murthy Grandhi, Company Profiles Analyst at GlobalData, comments: “The resilient demand for protection driven by risk awareness, rising property values, and strong segments like life and cyber insurance, coupled with strategic price adjustments and geographic diversification, allowed the global insurance industry to navigate the challenges and post a positive Q4 2023 performance.”

Life Insurance Corporation of India (LIC)

LIC saw an impressive 27.9% surge in market capitalization during Q4 2023, driven by the buzz surrounding its non-participating product, Jeevan Utsav. Additionally, the company's robust nodal agency network, commanding a 49% market share, played a pivotal role, contributing 96% of the new business premium by the first half of the fiscal year 2024.

Allstate Corp

Allstate Corp observed a 9.8% year-over-year (YoY) surge in total revenue during the fiscal third quarter ended on 30 September 2023 to $14.5 billion. Simultaneously, its cash balance escalated to $860 million, marking a 16.8% increase from $736 million reported on 31 December 2022. Looking ahead to the first quarter ending March 2024, analysts anticipate a 5% revenue YoY with an expected EPS of $3.37 potentially supported by a heightened occurrence of natural disasters that might enhance its market valuation further.

Grandhi continues: “Berkshire Hathaway experienced a slight dip in market capitalization owing to its performance in the fiscal Q3 2023. It generated a total revenue of $93.2 billion. However, the company reported a net loss of $12.6 billion, translating to a loss of $5.9 per share, representing significant deteriorations of 365.7% and 362.9% compared to the prior-year quarter. Concurrently, the company's cash and cash equivalents amounted to $25.6 billion during the same period, marking a decrease of 20.7% from the $32.3 billion reported as of 31 December 2022. Also, its share price could be potentially influenced by market fluctuations, sectoral performance, and adjustments in its investment portfolio.”

China Life Insurance suffered a 19.3% decline in its market value owing to its financial performance in the first nine months of 2023. It reported a 36% profit decline in the first nine months of 2023 due to stock market downturns and reduced bond yields impacting investment returns. Net income dropped to CNY35.5 billion compared to CNY55.5 billion a year earlier, under new accounting standards.

The equity-market slump and lower interest rates affected insurers' returns as they adjusted to new accounting rules reflecting asset market prices. While premium income rebounded post-COVID-19 pandemic, growth slowed in Q3 2023 as the sales of savings products eased. Investment income plummeted by nearly 86% to CNY22.6 billion, with fair-value losses increasing by 49% to CNY12 billion. Despite maintaining growth, the company faced challenges due to the complex market environment.

Ping An Insurance Group experienced a 16.7% decrease due to speculations about acquiring troubled developer Country Garden Holdings Co., prompting a selloff exceeding $5.5 billion.

Grandhi concludes: “For Q1 2024, GlobalData foresees the global insurance industry could be choppy with a potential global slowdown and volatile reinsurance costs. Continued demand for life and cyber coverage, China's reopening, and the adoption of InsurTech could push the industry forward. However, natural disasters, regulatory waves, and the ongoing Red Sea crisis may present unpredictable headwinds. Insurers who adapt, diversify, and manage risks are best positioned to ride the tide towards potential growth in this uncertain quarter.”

|