The P&I / Towers Watson global 300 research, conducted in conjunction with Pensions & Investments, a leading U.S. investment newspaper, shows that by individual region North America had the highest five-year combined compound growth rate of around 8% compared to Europe (over 7%) and Asia-Pacific (around 4%). The research also shows that the world's top 300 pension funds now represent around 43% of global pension assets1.

According to the research, defined benefit (DB) funds account for 67% of total assets, down from 75% five years ago. During 2014, defined contribution (DC) assets grew the most, by almost 5%, followed by defined benefit (DB) plans assets (almost 4%) and reserve funds2 (over 1%) while hybrid plan assets decreased by over 2%.

Chris Ford, global head of investment at Towers Watson, said:

“Ten years ago it would have been a brave person to have predicted a doubling of top pension fund assets globally. While liabilities have also ballooned, this still represents a significant increase in savings wealth. However there is a growing feeling that the investment industry, despite having grown assets, has not focused enough on the end beneficiaries’ needs or on managing costs in the ‘investment food chain’. Instead it has focussed on relative returns over total returns, and has allowed excessive risk to build up in portfolios at the same time as costs have increased to a level that is far higher than can be justified in aggregate. The top funds are already moving to address this and related issues and we can expect a very different industry in ten years’ time - or sooner given the inexorable shift to DC where the end beneficiary does indeed come first.”

According to the research, the U.S. remains the country with the largest share of pension fund assets accounting for around 38%, while Japan has the second-largest market share with around 12%. The Netherlands has the third-largest market share with 7%, while Norway and Canada are fourth and fifth largest, respectively, with around 6% share each. The research shows that 25 new funds entered the ranking during the past five years and, on a net basis, the countries that contributed the most new funds were the U.K. and South Korea (two funds), Russia, Australia, France, Peru, Vietnam and the U.S. (one fund). During the same period, Germany and Japan had a net loss of three funds from the ranking. The U.S. has the largest number of funds in the research (128), followed by the U.K. (27), Canada (19), Australia (16), Japan (15) and the Netherlands (13).

Chris Ford said: “The gradual reduction of extraordinary measures from central governments, which has underpinned equity markets since the financial crisis, is now being felt. Without QE tailwinds markets are arguably back to functioning normally which will reinforce many big funds’ belief in the value of being well diversified, particularly at times of stress which we are seeing again at the moment. As such we expect mature funds around the world to accelerate diversification away from equities and into other asset classes, as they continue to de-risk their portfolios and focus on total returns. Many leader funds have already transformed their governance structures to ensure they have a competitive advantage while transforming their portfolios, against a backdrop of anaemic global growth and benign inflationary conditions.”

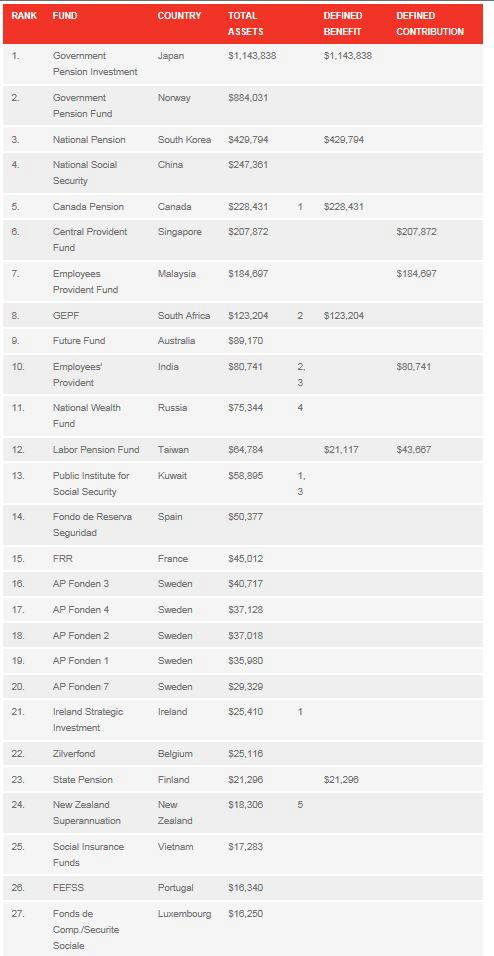

Sovereign pension funds3 continue to feature strongly in the ranking with 27 of them accounting for 28% of assets and totalling around US$4.2 trillion. The 114 public-sector funds in the research had assets of US$6 trillion in 2014 and account for 39% of the total. Private-sector industry funds (60) and corporate funds (99) account for 14% and 19%, respectively, of assets in the research.

Chris Ford said: "We have seen during the year a number of large funds making significant, and sometimes high profile, changes to the way they invest. This is in line with a single-minded approach of working hard in 'added-value spaces' to find the extra returns that no longer come from the market. In the process, they are increasingly thinking about diversification in the context of all return drivers and adding the necessary governance or outsourcing to ensure success. This is likely to increasingly polarise winners and losers and could reshape the investment industry, completing the shift away from siloed - and indeed expensive - 'asset class' thinking and increasingly breaking down the distinction between 'traditional' and 'alternative' investments."

|