Despite this first drop in assets since the beginning of the global financial crisis, cumulative asset growth since then is almost 19%. The P&I / Willis Towers Watson global 300 research, conducted in conjunction with Pensions & Investments, a leading U.S. investment newspaper, shows that by individual region North America had the highest five-year compound growth rate of around 6% compared to Europe (around 4%) and Asia-Pacific (around 1%). The research also shows that the world’s top 300 pension funds now represent around 42% of global pension assets1. According to the research during 2015, only hybrid plan assets grew, by almost 14%, while all other fund types declined: defined benefit (DB) plans assets by almost 5%; defined contribution (DC) by over 2%; and reserve funds2 by 0.3%.

Roger Urwin, global head of investment content at Willis Towers Watson, said: “The continuing tides of asset rises and falls combined with ever increasing liabilities bears testament to how difficult it has become for funds to meet their respective missions. Large asset owners can have an advantage in this volatile, complex and ambiguous investment world by improving organisational effectiveness to enhance decision making. It has become clear that good investment governance is the key determinant in producing the competitive edge necessary to transform portfolios and succeed in the ever-evolving mission of trying to pay benefits securely, affordably and in full.”

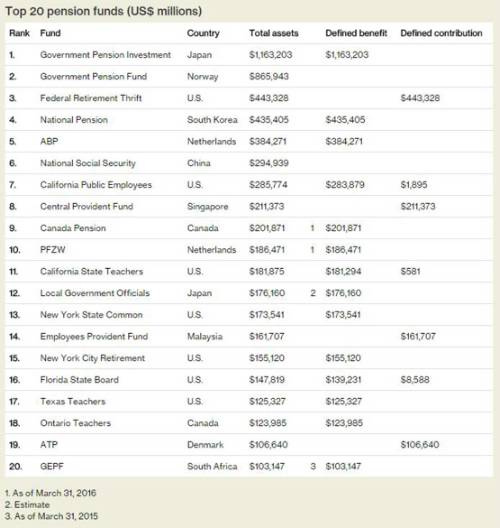

According to the research on the world’s leading funds, the U.S. remains the country with the largest share of pension fund assets accounting for around 38%, while Japan has the second-largest market share with around 12%. The Netherlands has the third-largest market share with over 6%, while Norway and the UK are fourth and fifth largest with around a 6% and 5% share respectively. The research shows that 27 new funds entered the ranking during the past five years and, on a net basis, the U.S. contributed the most new funds (ten funds) followed by the UK, South Korea, Australia, France, Peru, Vietnam and Italy. During the same period, Mexico had the largest net loss of funds from the ranking (four funds), followed by Switzerland, Germany and Japan (three funds). The U.S. has the largest number of funds in the research (131), followed by the U.K. (27), Canada (19), Australia (16), Japan (15) and the Netherlands (12).

Roger Urwin said: “There has been a fair amount of movement in the ranking in the past five years with winners likely being determined by having fully diversified portfolios that perform well in times of stress and a focus on total rather than relative returns. Another differentiator of leader funds is their ability to innovate or be an early adopter; critical in such a persistently low-growth environment. One area where investors have embraced this to their benefit is thinking innovatively about betas across all possible return drivers in their portfolios and balancing this with appropriate focus on capturing alpha. New thinking is being channelled in how to bring together internal and external intellectual capital in a cost-effective mix. This has had the welcome effect on the industry as a whole of sharpening the active management proposition and checking the rise in costs.”

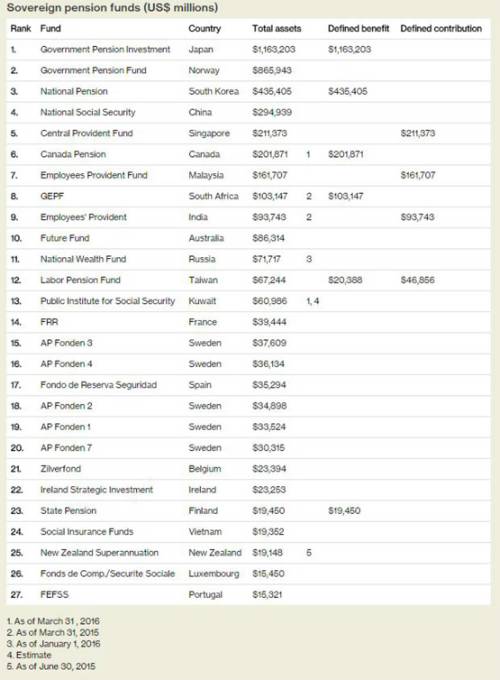

Sovereign pension funds3 continue to feature strongly in the ranking with 27 of them accounting for 28% of assets and totalling around US$4.2 trillion. The 115 public-sector funds in the research had assets of almost US$6 trillion in 2015 and account for 39% of the total. Private-sector industry funds (58) and corporate funds (100) account for 14% and 19%, respectively, of assets in the research.

Roger Urwin said: “The investment landscape is changing rapidly as more asset owners address their relatively weak investment governance position to become more effective in their investment process and practices. 20 years ago world-class asset owners were largely run through external delegation to outside firms. Now we're seeing much stronger capabilities among the biggest asset owners, and best investment practice is usually associated with getting a good balance between internal resources and external delegations. This strengthening of resources is also enabling these funds to be more keyed into their broader responsibilities, whether on the issues of ESG (environmental, social and governance factors), their ownership responsibilities and opportunities and, for a few funds, their pro-social impacts. This trend towards recognising the inter-connections integral to institutional investing is likely to accelerate and increasingly be an opportunity for differentiation.”

Footnotes

1 Estimation based on the P&I / Willis Towers Watson global 300 ranking and Willis Towers Watson Global Pension Asset Study.

2 Reserve funds are set aside by a National government to guarantee pension payments and are characterised by no explicit liabilities and hence are neither DB nor DC.

3 As established by national authorities for the meeting of pension liabilities. We acknowledge that there are many other state-sponsored funds established – we have attempted to restrict this to funds specifically sponsored by national authorities.

|