Whether your home has been the victim of severe weather conditions or you’ve suffered a fire or theft, home insurance is an important protection. And although the chances of one of these unlucky scenarios happening may seem low, there are a staggering number of home insurance claims made every year.

Looking at home insurance quotes data from 2024, Go.Compare’s home insurance experts have revealed the most common reasons people make a claim on their home insurance - and found it can vary significantly depending on where you live.

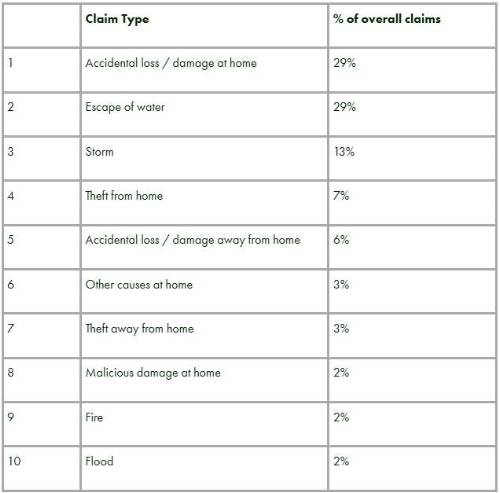

The data reveals that accidental loss or damage at home is the most common reason people claim on their home policy. These kinds of claims could be made due to drilling through pipes, carpet spills or other blunders. So far in 2024, there have been 13,640 accidental loss or damage claims lodged for this reason - accounting for well over a quarter (29%) of all home insurance claims made. And in the top spot, Telford is currently home to the most accident-prone people, followed by Worcester and St Albans.

In second place, there were 13,557 claims (29%) lodged for escape of water, with the highest number coming from Watford. Water damage can occur for a number of reasons, whether it’s due to a burst pipe, a faulty appliance or even a dripping tap.

Storm damage is the third most common reason people claim on their home insurance, and across the UK, Jersey has the highest number of these claims, taking up 9% of the total - far higher than the location with the second highest number of claims, the Outer Hebrides (4%).

Meanwhile, London boroughs have seen the highest number of claims for theft both in and outside the home - with North and East London taking the top two spots for home theft, and South West and West London having the most claims for theft outside the home.

Commenting on the findings, Nathan Blackler, Go.Compare home insurance spokesperson, said: “Accidents happen more often than we’d like to think, and it seems these moments are the number one reason we have to make a claim on our home insurance - whether it’s spilling wine on the brand new sofa, drilling through a water pipe or breaking a window.

“Other top reasons you might need to make a claim include escape of water, storms and theft - though it’s worth remembering that depending on your policy, your home insurance could protect you from a wide range of things besides these.

“On the other end of the spectrum, the rarer claims that were recorded in the report include explosions - of which there have been just five this year - plus lighting damage, oil leakage and fallen trees.

“And while the data suggests some claims may be more likely in certain areas, it’s important to get the right protection in place regardless of where you’re based. We always recommend comparing home insurance policies online so you can make sure you get the best cover at a price that suits you.

“Also, to lower the risks of any mishaps at home, make sure to keep up with regular maintenance and keep your home as secure as possible. We recommend:

Bumping up home security: deter thieves by installing alarms and using sturdy, approved locks on windows and doors.

Protect against weather damage: check regularly and fix external problems like loose roof tiles, clogged guttering and damaged outbuildings, before they become a bigger issue.

Trim back trees: maintain any trees close to your property so they cause minimal damage if they fall, and clear away any fallen branches.

Check and insulate pipes: assess the condition of outside pipes and taps, and insulate them when cold weather approaches to prevent them freezing and bursting.

“For any repairs or maintenance you aren’t confident about completing yourself, it’s always best to talk to a qualified tradesperson. Insurers may check how well repairs have been carried out, and the success of your claim could depend on them determining whether the job has been completed correctly. So, if in doubt, seek a professional.”

|