The new UK data is drawn from the WEF’s proprietary Executive Opinion Survey (EOS), which provides a unique window into global business conditions and which, among many other things, asks respondents to identify the five biggest risks to doing business in their respective countries. In 2017 the EOS was conducted between February and June and the question on risks to doing business was answered by 12,411 executives across 136 countries. The UK findings are based on responses from 83 UK executives.

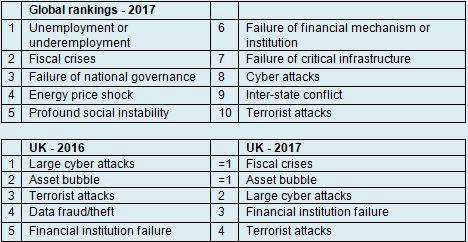

While the risk of cyber attacks is ranked among the greatest dangers for businesses globally over the next 10 years - reflecting executives’ increasing concerns about cyber security - it has been replaced in the UK’s top spot this year by fiscal crises and an asset bubble.

Mark Weil, CEO, UK & Ireland, Marsh, said: “This year, the combination of high stock markets and government and personal debt levels, together with uncertainty surrounding Brexit and already fragile economic growth, are of particular concern to UK executives.”

He went on to say, “However, following a number of high-profile cyber attacks this year, it’s clear that UK leaders remain gravely concerned about cyber security and the threat cyber risk poses to doing business in the UK. No single solution is a panacea but there are measures UK firms can take to ensure they are well protected against attacks and best placed to survive them.”

John Scott, Chief Risk Officer, Commercial Insurance, Zurich, said: “Today we operate in a complicated macro-economic and geopolitical environment with a huge degree of uncertainty and constant change. It’s more important than ever that businesses have clear risk management strategies in place to help them withstand any unforeseen consequences and build greater resilience within their business. Looking at the survey results more closely, it seems whilst business leaders are aware in the medium term of social and economic risks to their businesses, they are perhaps underestimating the potential impact of environmental and technological risks and there is an opportunity for insurers to help businesses address this in the future.”

Since 2006 the World Economic Forum has provided world-leading analysis of the evolving global risks landscape in its flagship Global Risks report, which is produced each year in collaboration with strategic partners Marsh & McLennan Companies (MMC) and Zurich Insurance Group (Zurich). The next edition of the Global Risks Report will be released in January 2018.

For an article further explaining the results of the survey, click here: http://www.brinknews.com/GMD

To see the full survey results, including the results by region and for the 20 countries whose information is released today, click http://bit.ly/wefsurvey17 ">here:

|