Half (50%) of the over 50s who are thinking about or planning on moving abroad when they retire are reconsidering where they might retire to due to Brexit, up from 46% in 2020. A further 47% (up from 44% in 2020) say the uncertainty is making them reconsider their plans altogether. When asked about the pandemic, two in five (42%) of the over 50s planning to retire abroad say they are reconsidering which country to retire too, while a further 39% say they are thinking about whether to retire abroad at all.

The notion of retiring abroad has long been on the wish list for Brits in search of better weather (69%), a more desirable lifestyle (62%), and cheaper living costs (45%).

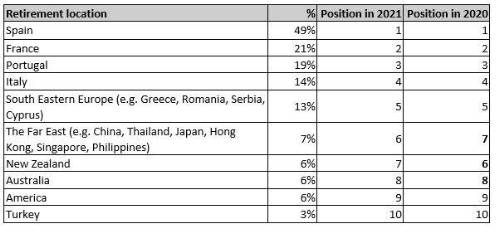

For the ninth year running, Spain tops the charts as the most popular overseas retirement destination.

With many retirees considering moving abroad for a cheaper standard of living, the average monthly income needed is thought to be £1,461 - £367 less than the UK. This varies by country, with those hoping to retire to America thinking they will need the most at £1,916 per month, followed by New Zealand (£1,664). Unsurprisingly, retiring in the UK is considered to be more expensive than retiring to most popular overseas countries, and on average the over 50s thought it would require a monthly household income of £1,828, increasing to £2,082 for London.

For those considering retiring abroad, it’s important to consider the impact of reciprocal social security agreements. Countries in the EU - as well as many others - have these agreements with the UK, which means the State Pension will increase each year in the same way as retirees living in the UK - but it’s important to understand whether the agreements are in place further afield2. Currently3, of the State Pensions which are paid overseas, 43% are frozen.

The research revealed, however, that just one in five (19%) of those planning to head abroad know which countries had reciprocal payment agreements in place, and one in four (25%) did not even know such agreements existed.

Offshore bonds can play a role in expatriate financial planning as they can be left to grow almost free of tax with no restrictions on how much can be invested. They can also be a vehicle for additional savings without the hassle of dealing with complicated pension regulations. The choice of country can also be advantageous as when money is withdrawn the taxation rules of the country in which the client resides will apply.

Sean Christian, MD and Executive Director, Wealth Management Division for Canada Life commented: “Despite Brexit and the ongoing global pandemic, many over 50s continue to harbour the dream of a retirement which includes better weather, a more desirable lifestyle, or cheaper standards of living than the UK.

“There are a number of key considerations when planning a move abroad, such as which countries offer reciprocal payment agreements, thinking about the impact of currency exchange rates and whether State Pensions will keep pace with the cost of living. To help navigate the complexities around retiring abroad, it’s important to seek specialist professional advice. An expert in expatriate finance will be able to help and ensure you make the most of the retirement people have worked long and hard for.”

Top tips for retiring abroad

1. Get an estimate of your state pension here.

2. Seek independent financial advice before you move – to find an adviser go to www.unbiased.co.uk – you can search for experts on expatriate finance

3. Tell HM Revenue and Customs that you are moving overseas. This allows them to let you know of any UK tax liability you may have even though you are planning to live overseas. And more importantly can allow any UK pension you have to be paid gross (no tax deducted) and taxed in your country of residence (only applies if the country you live in has a double taxation agreement with the UK).

4. Check what reciprocal social security agreements are in place with the destination country regarding your UK state pension [including whether it will be increased or frozen] and other benefits

5. Find out about your welfare rights while abroad

6. Keep an eye on exchange rates as state pension and other income is likely to be paid to you in pounds and you will then need to convert to the local currency which may mean your income fluctuates

7. Check the cost of healthcare in the country you are thinking of moving to, and consider some form of medical insurance

8. If you decide to keep your property in the UK you will need to let your mortgage provider and insurance company know if it will be rented or remain empty

9. Do your homework on the cost of living in the country you want to move to

10. Notify utility companies, financial institutions and your local council when you are leaving

11. Contact the electoral register, and arrange for mail forwarding via the Post Office

12. If you plan to keep an account at your UK bank, contact it and ask if you will face any new rules or restrictions after moving abroad

|