Tom Selby, director of public policy at AJ Bell, comments: “A decade on from former chancellor George Osborne’s bombshell pension freedoms announcement at the March 2014 Budget and the tax system which governs flexible retirement withdrawals remains faulty.

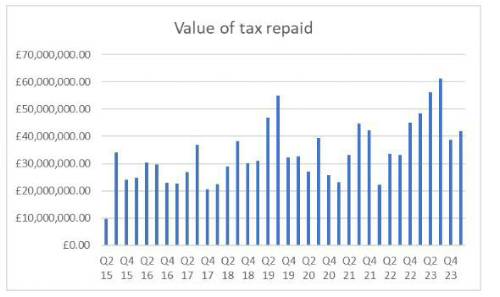

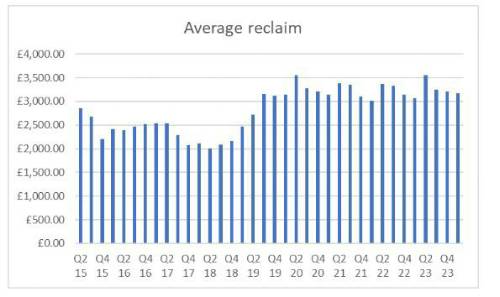

“The latest official figures reveal over £1.2 billion has now been repaid to savers who were overtaxed on their first withdrawal and filled out the relevant HMRC form to claim their money back. In the 2023/24 tax year alone, a record £198 million was repaid to people who had been clobbered with an unfair – and often unexpected – tax bill.

“Depressingly, the true overtaxation number will likely be substantially higher. In particular, people on lower incomes who are less familiar with the self-assessment process might be less likely to go through the official process of reclaiming the money they are owed. As a result, they will be reliant on HMRC putting their affairs in order.

“It is simply unacceptable that the government has failed to adapt the tax system to cope with the fact Brits are able to access their pensions flexibly from age 55, instead persisting with an arcane approach which hits people with an unfair tax bill, often running into thousands of pounds, and requires them to fill in one of three forms if they want to get their money back within 30 days.

“One way savers planning to take a single withdrawal in a tax year can potentially avoid the shock of a big overtaxation bill is by taking a notional withdrawal first. This should mean HMRC is able to apply the correct tax code to the second, larger withdrawal.

“Alternatively, you can fill out one of three HMRC forms and you should receive your tax back within 30 days. If you don’t do this, the Revenue says it will put you back in the correct tax position at the end of the tax year.”

Source: AJ Bell analysis of HMRC data

Why are savers overtaxed on pension withdrawals?

Since 2015, HMRC has chosen to tax the first flexible withdrawal someone makes in a tax year on a ‘Month 1’ basis.

This means HMRC divides your usual tax allowances by 12 and applies them to the withdrawal, landing hard-working savers with shock tax bills often running into thousands of pounds.

While those who take a regular income or make multiple withdrawals during the tax year should be put right automatically by HMRC, anyone who makes a single withdrawal will likely be left out of pocket.

It is possible to get your money back within 30 days, but only if you fill out one of three HMRC forms to reclaim your money. If you don’t, you are left relying on the efficiency of HMRC to repay you at the end of the tax year.

How to get your money back if you are overtaxed

If you are taking a steady stream of income via drawdown then you shouldn’t need to take any action, as HMRC will adjust your tax code to ensure that over the course of the year you are taxed the correct amount.

However, if you make a single withdrawal then you will either need to fill out one of three forms or rely on HMRC putting you in the correct position at the end of the tax year.

Which form you need to fill out will depend on how you have accessed your retirement pot:

If you’ve emptied your pot by flexibly accessing your pension and are still working or receiving benefits, you should fill out form P53Z,

If you’ve emptied your pot by flexibly accessing your pension and aren’t working or receiving benefits, you should fill out form P50Z,

If you’ve only flexibly accessed part of your pension pot then use form P55.

Provided you fill out the correct form HMRC says you should receive a refund of any overpaid tax within 30 days.

|