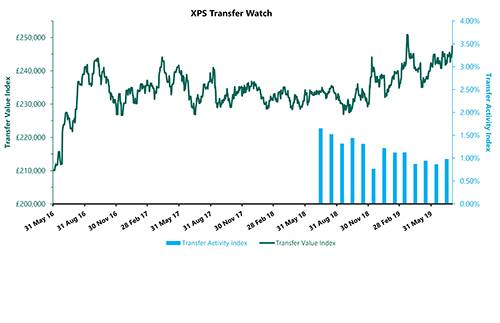

XPS Pensions Group’s Transfer Value Index increased steadily over July to end the month at £247,400, up from £240,800 at the end of June. The increase was driven by a reduction in gilt yields over the month.

XPS Pensions Group’s Transfer Activity Index recorded an increase in the number of transfers that the administration business processed during July, compared to recent months. The transfers processed would imply an annual equivalent of 0.98% of eligible members, compared to 0.87% last month. Despite the increase, this still remains below the average that we have seen over the last 12 months of 1.13%.

In market news, the Financial Conduct Authority (FCA) released a consultation on 30 July setting out their proposals to change how financial advisers deliver pensions transfer advice. Most noteworthy is the proposal to ban the widespread practice of contingent charging, where the amount an adviser is paid depends on whether the transfer goes ahead. The consultation closes on 30 October, with any changes expected to be implemented in early 2020.

Mark Barlow, Partner, XPS Pensions Group commented: “The continuing fall in gilt yields is driving transfer values towards record levels. In fact, the end of July interest rate, net of inflation, was the lowest month end figure recorded since the inception of the Transfer Value Index. It is only recent slowdowns in life expectancy improvements that have stopped the index hitting record levels this month. However, transfer activity appears to be unaffected, remaining relatively stable at an annual rate just below 1%.

“We have been concerned for some time about the obvious conflicts of interest that arise when advisers are paid more if a member transfers their benefits and the FCA’s consultation is an important step towards safeguarding members’ benefits. However, a ban could suppress transfer activity as advisers withdraw from the market and members are put off taking advice because of the up-front fees. It is important that pension schemes put in place a process now to ensure their members have access to high quality advice when they need it.”

|