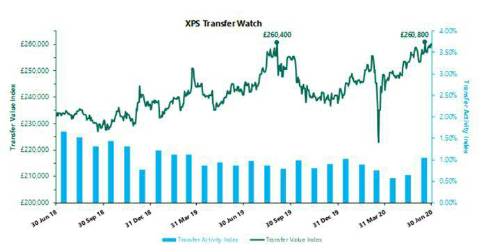

Defined benefit (DB) transfer values increased to a record high during June and the number of members taking a transfer value rebounded strongly from the lows observed in recent months, according to XPS Transfer Watch. XPS Transfer Watch monitors how market developments have affected transfer values for an example member, as well as how many members are choosing to take a transfer.

XPS Pensions Group’s Transfer Value Index rose from £258,600 at the end of May to reach a record high of £260,800 in mid-June, before falling slightly to end the month at £259,700. The increase was a result of a rise in long-term inflation expectations during the month, partially offset by rising gilt yields.

XPS Pensions Group’s Transfer Activity Index rebounded strongly in June, with the number of completed transfers increasing to an annual equivalent of 1.05% of eligible members, the highest rate seen since March 2019. This represents just over 10 in every 1,000 eligible members transferring each year.

In market news, the Work and Pensions Committee chair, Stephen Timms, has declared his intention to table an amendment to the Pension Schemes Bill, allowing schemes to pause a transfer where a scam is suspected. This was after he commented that the Norton Motorcycles scam case "raises serious questions about the effectiveness of the regulators involved and the protections we have for people who fall victim to scams".

Helen Ross, Head of Member Options, XPS Pensions Group commented: “The increase in transfer activity during June is possibly the market catching up following low activity levels since lockdown, due to members hesitating over such big decisions or pension schemes temporarily suspending transfers. However, transfer quotation requests have also increased recently, meaning that we could see this trend continue in the short term.”

“Transfer values rose to record highs during June, which means a transfer will be increasingly tempting. With members facing unique pressures over the coming months, we are concerned about a potential increase in poor outcomes, including pension scams. It is now possible for schemes to identify whether their members are vulnerable to scams and put protections in place High quality financial advice will be crucial here in helping members to make the right decision for their circumstances and, during a recent webinar following the launch of our 2020 member outcomes survey, over 85% of attendees agreed that pension schemes had a role to play in helping their members access advice.”

|