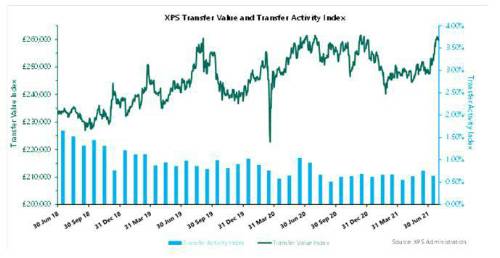

DB pension transfer activity dipped slightly over the month. The Transfer Activity Index showed that an annualised rate of 64 members out of every 10,000 transferred their pension.

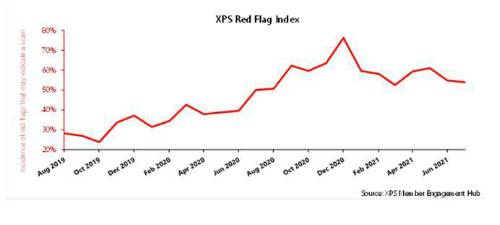

The Scams Red Flag Index in July remained at a similarly high level to last month, with 54% of transfers showing at least one warning sign of a potential scam or poor member outcomes.

XPS Pension Group’s Transfer Watch monitors how market developments have affected transfer values for a typical pension scheme member. In addition, it monitors how many members are choosing to take a transfer from their DB pension scheme and, through its Red Flag Index, the incidence of scam red flags identified at the point of transfer.

On 9 July, the Department of Work and Pensions (DWP) launched a consultation on a “stronger nudge to pensions guidance”. This proposes that pension schemes should be obliged to refer members to Pension Wise guidance before they access their benefits, as well as offering to arrange the appointment on their behalf.

Mark Barlow, Partner, XPS Pensions Group commented: “With transfer values back to record highs, it’s as important as ever that members are provided with as much support as possible when considering a transfer. Encouraging people to seek Pension Wise guidance is a sensible step, but for those deciding to leave their DB pension scheme it is imperative they also have access to high quality unbiased financial advice.”

Helen Cavanagh, Client Lead, Member Engagement Hub, XPS Pensions Group added: “Although the red flag index has stabilised this month, it remains at a concerning level. For cases where we identified a warning sign, almost 60% raised concerns relating to fees, including a lack of understanding of the fees that they will be paying in the receiving scheme. This could indicate members are transferring to arrangements that could give poorer retirement outcomes.”

Chart 1 – XPS Transfer Value and Transfer Activity Index

Chart 2 – XPS Red Flag Index

|