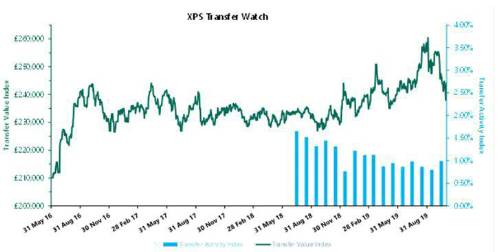

XPS Pensions Group’s Transfer Value Index fell from £254,300 at the end of September to £244,200 at the end of October. The movements were driven by increases in gilt yields and a fall in expected inflation over the month.

XPS Pensions Group’s Transfer Activity Index recorded an increase in the number of transfers completed in October, to an annual equivalent of 0.99% of eligible members, up from 0.80% in September. This is the highest rate seen since March, but still broadly in line with long-term rates.

In market news, the Queen’s Speech on 14 October announced a Pension Schemes Bill 2019-20, which includes provisions to limit the range of circumstances under which a statutory right to a transfer value exists. In short the government introduced safeguards to allow trustees to refuse a transfer where there is a risk of a transfer being to unregulated funds. Although the forthcoming general election on 12 December 2019 means that the Bill has fallen away, it is hoped that the cross-party support that it had received means it will return over the coming months.

Mark Barlow, Partner, XPS Pensions Group commented: “October was another turbulent month for the financial markets. The rise in gilt yields has resulted in the largest fall in our Transfer Value Index since its inception, with transfer values 4% down on the previous month end. However, transfer activity has increased substantially which is possibly a reaction to the record high transfer values seen over the summer months.

“The Pension Schemes Bill 2019-20 was not expected to have a significant effect on transfer activity but it was intended to protect members from scam activity. Protecting members from such activity has been a focus for us in recent years and we hope that the protections envisaged by the Bill are not lost as a result of the forthcoming general election.”

|