The Life & Pensions industry is in the throes of a major upheaval, and companies are well aware of the need to change the way  they work to succeed in a new world driven by more stringent regulations, greater access to pension funds and changing customer behaviours.

A key catalyst for escalating concern is huge regulatory change and the substantial cost overheads this is likely to generate for insurance companies. Significant recent reforms include the largest overhaul of the pensions system in a generation, new regulations from ‘Solvency II’, and RDR reforms eliminating commission payments. This is in addition to a greater compliance focus on sales processes - which has already seen regulatory investigations into policies sold tens of years ago – and in particular a longer-term requirement to be operationally more transparent.

Yet more change is on the horizon, as the government considers rewriting tax rules. This would turn on its head the current system of savers receiving tax relief when they pay into pension schemes then being taxed on the income at retirement, to paying tax upfront with future pension payments being tax-free. These changes could open up the market to investment houses and digital platforms. The latter organisations are already starting to compete in the pensions’ space, after the Pensions Reform Act in April 2015 gave customers far more choice in how they take their pensions, slashing the market for annuities that had previously been a strong revenue stream for insurers.

It is not only new regulation demanding industry transformation. Concerns about economic uncertainty and low interest rates are driving down investment returns, threatening the future of traditional life insurance, savings and pensions products. New, innovative product offerings are being developed - but with the quest for higher returns comes higher risk. Moreover, increasing costs of reserving are forcing companies to increase reserves on long-tail business, which is reducing return on equity and may well lead to further market consolidation.

Furthermore, the mechanism by which the life insurance industry operates is urgently due an update. Meeting customer expectations through electronics channels must be prioritised as the traditional way that insurance is sold - through personal contact and advice – needs to be redefined to meet the needs of a new generation of digital customers. This is an imperative especially given that the opening up of the market will expose the insurance industry to unfavourable comparisons with other financial services channels, which have been considerably faster in adopting new technologies.

So what does this mean for businesses?

Faced with this raft of seismic shifts impacting some of the most fundamental practices in the Life & Pensions industry, there is a clear need for traditional companies to reorganise, consolidate, and essentially to cut costs by at least 20% over the next two years and in some cases up to 40%. The only way this can be achieved is by making sizeable and ongoing investments in technology.

In order to actually achieve these cost savings, companies must focus on the following

- Improving levels of automation within the back-office

- Introducing/enhancing self-service channels for high growth retail savings products

- Eliminating paper through better use of electronic forms and statements

- Capturing market share and differentiating offerings from the rest of the market

- Retaining legacy pension customers during their retirement

Life insurance companies are all too familiar with the issues at stake and they must make sure that they are investing their money in those initiatives that not only give them the greatest return on investment, but also have the biggest impact on customer experience. The reality is however that many insurance executives have no clear grasp of where this ’Change Journey’ begins or ends, due to their lack of understanding of the key operational cost drivers that underpin their business.

Typical questions that executives need answers to in order to re-align and optimise their business models, but which often prove difficult to obtain due to insufficient operational transparency, are;

• What are our baseline operational costs across core processes, products and channels?

• What are the key drivers of performance and how can I reduce costs, improve service levels and increase revenue?

• What does leading practice look like and how far away is my business from achieving it –are we lagging behind the competition?

However, the current fragmented way of approaching cost saving challenges means companies are often acting in silos, rather than treating each area of the business as mutually influential and inextricably linked work streams.

The key issue driving this ‘silo behaviour’ is the lack of a consistent measurement framework across business units, products and channels. This lack of transparency is preventing insurance companies from identifying real opportunities to improve efficiency and to create value, and is therefore impeding their ability to make the right investment decisions.

What should this framework look like?

A consistent framework needs to provide a holistic view of comparative costs, staffing and service quality that can be utilised across all business functions, underpinned by consistent data collection throughout the organisation to reach full transparency.

Such a framework allows executives to conduct a top down review of operational metrics enabling analysis of root-causes for performance failures and providing a clear understanding of the costs and quality of delivery across business functions. Only then can organisations identify real opportunities to realise optimum efficiency and create customer value.

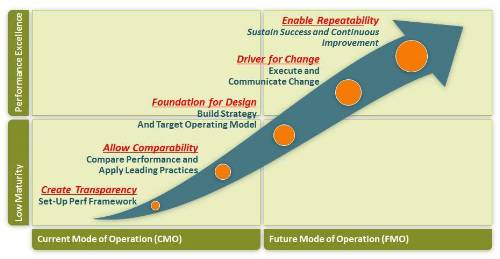

This diagram is a suggestion of what a skeleton framework could look like:

Although it might take time to disentangle an organisation and therefore allow the implementation of an effective framework it is an essential process to undertake, as it is impossible to drive positive and long-lasting change without being able to measure – and transparency is impossible without measurement.

|

they work to succeed in a new world driven by more stringent regulations, greater access to pension funds and changing customer behaviours.

they work to succeed in a new world driven by more stringent regulations, greater access to pension funds and changing customer behaviours.