Nearly 100,000 more patients fund private health treatment with PMI than self-pay in Q2 2024

Analysis of the latest quarterly Private Healthcare Information Network (PHIN) data demonstrates the increasingly prominent role employers are playing in boosting growth in the private healthcare market and reducing pressure on the NHS’ stretched resources.

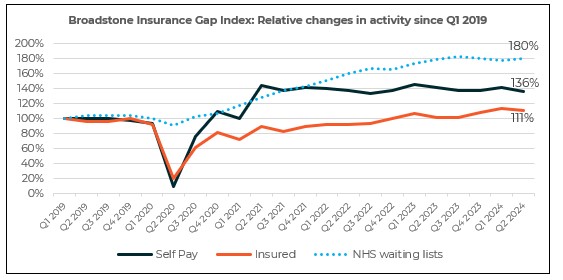

The research from Broadstone, a leading independent consultancy, shows that treatments funded through Private Medical Insurance (PMI) registered a record first half of the year with a total of 333,000 admissions. This is up 8% from H1 2023 (309,000) and 15% compared to H1 2019 (290,000) with insured admissions currently at 111% of pre-pandemic levels.

Self-pay rebounded rapidly following COVID-19 as patients dipped into pandemic savings to fund access to treatment. Self-pay admissions are still at 136% of pre-pandemic levels but have since plateaued meaning the rapid growth in the private health market is now being driven by insurance solutions.

In Q2 2024, PMI funded treatments equalled over seven in ten (71%) of all admissions with the gap in admissions between those paying with PMI and those using ‘self-pay’ increasing year on year, reaching 96,000 in Q2 2024 compared to 80,000 in Q2 2023.

Brett Hill, Head of Health & Protection at Broadstone, commented: “Corporate-funded medical insurance continues to be the key driver behind the private health sector’s remarkable growth in recent years. As the NHS grapples with a huge backlog in patients, it is struggling to meet the healthcare needs of the UK population. Private healthcare, therefore, is increasingly becoming the go-to option for corporates seeking timely screenings, diagnoses, and treatments for their workforce to avoid absenteeism and long-term inactivity.

“However, this surge in PMI coverage has been accompanied with an increase in claims volumes which, coupled with the rising complexity of medical conditions, has led to higher claim costs for insurers, with employers now feeling the impact via escalating PMI premiums. Preventative programs that can spot issues earlier can help bring down the cost of healthcare packages by minimising treatments for more complex, expensive health conditions.”

|