Some of the key issues in the True and Fair Campaign response include:

-

The FCA should look to ensure a consistent regulatory regime between insurance based investment and pension products, and MiFID II investments as many savers look at the raft of products available to them – pensions, investments, investment trusts and Exchange Traded Products. Consistency is therefore vital to afford savers the ability to make like for like comparisons.

In term of buyer behavior and buying trends consistency is also paramount as consumers are increasingly making these vital decisions themselves and choosing between a wide range of products and providers. Any inequality of regulation will allow companies to ‘game’ the regulation by artificially ensuring their products come within whichever region has the lightest regulation and poorest consumer protection.

-

Local authorities should be re-categorised as retail clients. Local authorities have often been at the heart of mis-selling scandals and their investment innocence will always make them susceptible, with many of their advisers and consultants conflicted and in our experience guilty of providing poor quality advice. This is particularly prevalent within the management of their monies where consultants are able to offer their own services and regularly appear on their own organised beauty parades. It is our view there is also the bigger picture that as Local Authorities’ money is ultimately for the public and vital to our communities, they require the greater protection offered by retail rather than professional status.

-

On the question of the MiFID II’s standard of independent advice versus the UK’s RDR standard, we believe there is a different in terms of allowing an adviser to be independent if say they are a specialist in one product area of activity rather than the RDR standard which requires an independent adviser to have knowledge of all product areas.

In practice it is highly doubtful that many advisers are genuinely whole of market as evidenced by their continued over-whelming concentration on mutual funds rather than the various alternatives available. There are many advisors for example who use one of the largest platforms which currently does not offer ETFs at all. It is highly questionable that any adviser solely using this very large platform could possibly be independent since they would not have access to all product types, yet to date the FCA has seemingly been silent with regard to questioning the independent status of advisers attached to this platform. Most advisers appear to use one platform, and if that platform isn’t whole of market, then those advisers cannot be independent by the RDR definition. Being a professional, specialist adviser should not rule an adviser out of being independent.

-

We agree there should be a standardised format for disclosing costs and charges for both point-of-sale and post-sale disclosures?

The only way to properly implement the spirit of the original EU laws, as rightly pointed out by ESMA is to ensure that there is consistency between the MiFID II costs and charges requirement, the PRIIPs Regulation and the UCITS Directive, to avoid consumer confusion. This can only be achieved by having a standardised format for disclosing costs and charges for both point-of-sale and post-sale disclosures.

The arguments for having different formats are intellectually bankrupt and are being spouted by those that are conflicted and are deliberately aiming to confuse consumers and avoid material costs being shown pre-disclosure. Where the cost cannot be firmly calculated pre investment, it should be estimated and based on the average of the last three years data where available.

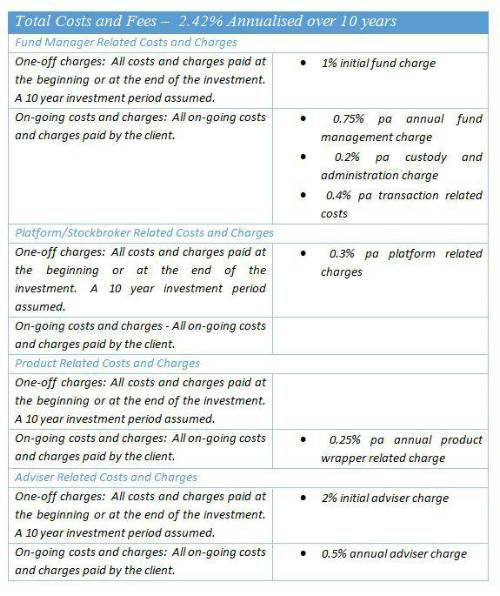

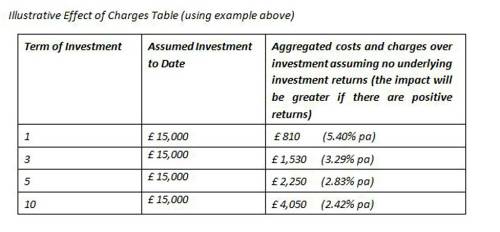

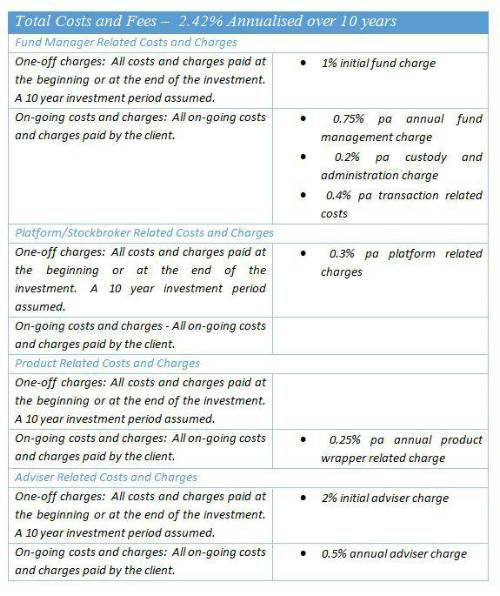

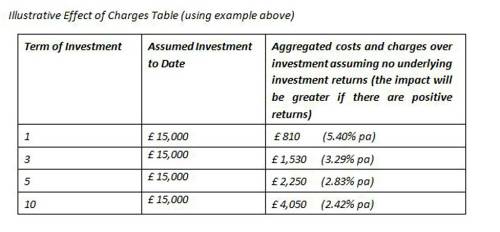

We would suggest the following standardised format that sets out to achieve disclosure of all the costs at all levels, aggregates these costs, shows them in a monetary amount as well as a percentage, and over the course of the investment:

In order to annualise the various costs of which some may be initial costs and some ongoing costs, these should generally be annualised over 10 years. It may be more appropriate for a pension for it to be annualised over a longer period, say 25 years.

-

Apply MiFID II’s appropriateness test to insurance-based investments, factors or criteria we consider make an insurance-based investment and pension product complex. In our view, there is a complete misnomer in terms of what is currently viewed as being complex or not. The complexity should not only be looked at in terms of the complexity of the inputs of production, but the complexity of the outcomes and likely understanding of the key characteristics, risks and likely outcomes of the product. For example, whilst many structured products are incomprehensible to the layman and even experts, it is not impossible to construct a product which is easy to understand e.g. will require a fixed five year term, will provide 110% of the FTSE100 return in terms of the capital index without income, will guarantee a minimum of 100% of capital returned at the end of 5 years. BUT the investor will not keep the income paid out by shares and the guarantee is dependent on the company providing the guarantee being solvent at the end of year 5. Arguably this example is easier to understand than many so called non-complex products currently.

For example, there is currently a very high-profile UCITS fund (with over £25 billion invested) that is sold to retail investors but which invests in highly complex investment strategies normally the preserve of hedge fund professional investors, which is so complex that it is highly unlikely that many advisers or retail investors comprehend it, and within which the key counterparty risks are entirely unquantified and the

key individual counterparties completely un-named. In our view such products should be appropriately classified as suitable only for professional investors.

Gina Miller, Founder of the True and Fair Campaign said,

“We are aware that several associations and companies have been hysterical in their responses to the FCA consultation in term of the supposed astronomical costs, lack of available data and the limiting on their ability to flog funds if they are made to comply with MiFID II. Many of their objections are grossly exaggerated and simply amount to feet dragging in order to defend their inflated profit margins. The FCA should be rigorous in applying consistency, and ensuring a level playing field across all products and all companies.”

|