“The unpredictable nature of a Trump administration creates uncertainty, especially if protectionist rhetoric starts to outweigh promises of stimulus. However, global growth is picking up and monetary policy is likely to remain loose in most developed countries despite an upturn in inflation. With the Investment Clock model supportive of stocks and commodities, we would probably view dips as a buying opportunity.”

Nominal growth is surging, this will be positive for stocks and commodities.

“The Investment Clock has been in the Overheat phase of the business cycle since last summer. Things have really heated up recently in what looks to be the strongest surge in nominal growth since the financial crisis.

Hopes of loose US fiscal policy and deregulation under Trump could add fuel to the fire. Historically commodities have done best at these times1. However, with monetary policy likely to remain behind the curve, stocks should continue to do well.”

The Fed will be a lone hiker, a positive for the US dollar and Japan

“Very few central banks are likely to respond to higher inflation with higher interest rates. The European Central Bank and Bank of Japan are printing money and the Bank of England will want to keep policy loose while Brexit negotiations are in progress.

“With only the US Federal Reserve likely to raise rates, dollar strength is likely. Bouts of dollar weakness can be used to add to positions in Japanese equities, which tend to do well when the yen is weak and global growth is strong.

Climbing the wall of worry

“Political risk is likely to create bouts of negativity in 2017. We have a new and unpredictable leader in the White House, Brexit negotiations and a series of important elections in Europe and it would not be surprising to see red on the screens from time to time.

“We will be watching our investor sentiment indicator closely. With global growth picking up and the earnings outlook improving, we would most likely view dips as a buying opportunity.”

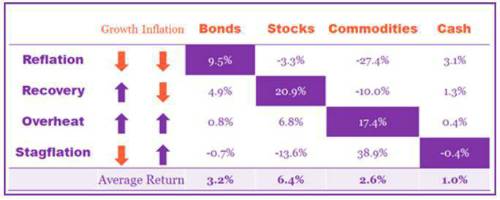

Focus Table: Real returns in different Investment Clock phases

Source: RLAM Analysis from April 1973 to April 2015. Real returns in US dollar terms. Indices used are – Bonds: ML Treasury & Agency Master, Stocks: S&P Composite, Commodities: GSCI Commodity index and Cash: US 3-month T Bills

The Investment Clock approach splits the business cycle into four phases depending on the strength of growth and the direction of inflation. In the Overheat phase commodities are usually the best asset class but with monetary policy likely to remain loose around the world, we think stocks have further to run.

|