Moreover, Trump increased the US tariff rate on steel and aluminum to 25% on 10 February, removing country-specific exceptions and quota arrangements. Consequently, North American region insurers may see increased claims costs in 2025 across various insurance lines, potentially affecting their profitability, says GlobalData, a leading data and analytics company.

After discussions between the US President and leaders from Mexico and Canada, the proposed tariffs on imports from Canada and Mexico and the retaliatory tariff are delayed by a month. In its retaliation, Canada specified that tariffs on CAD30 billion ($22.8 billion) would take effect immediately from 4 February 2025, and tariffs on the remaining CAD125 billion ($95 billion) would follow within 21 days. Set to take effect on 12 March 2025, the US tariffs will impact imports of millions of tons of steel and aluminum, affecting goods previously duty-free from countries like Canada, Brazil, Mexico, and South Korea.

Manogna Vangari, Insurance Analyst at GlobalData, comments: “Upon implementation, high tariffs will significantly affect trade throughout North America, not solely due to the substantial volume of commerce but also owing to the critical role of supply chains, which account for more than half of intra-regional trade, as per GlobalData’s estimates. Furthermore, the Trump administration plans to raise tariffs on oil and gas in March 2025. This is expected to have a detrimental impact on the insurance industry, manifested by reduced economic activity and consumer spending. However, it is expected that Canada, Mexico, and China will soon contest these tariffs by initiating a legal case with the World Trade Organization (WTO).”

The North America region’s property and motor insurance claims are projected to represent a 13.4% and 16.1% share of total general insurance claims in 2025. However, the full and actual implementation of the tariff rates may push actual claims even higher. Consequently, the profitability of North America’s general insurance sector is expected to be notably affected, with claims projected to grow at a rate of 6.9% in 2025 from 3.3% in 2024.

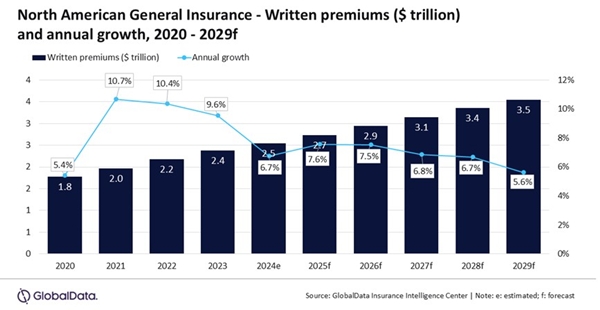

According to GlobalData’s Global Insurance Database, North America’s general insurance industry is expected to grow at a compound annual growth rate (CAGR) of 6.7% over 2025–29, from $2.7 trillion in 2025 to $3.5 trillion in 2029, in terms of written premiums.

Vangari continues: “Tariffs on imported materials like building supplies, car parts, and electronics will increase the cost of vehicle repairs and property reconstruction after disasters, causing insurers to pay more claims across the region. Insurance companies may raise premiums for property and motor policies.”

Around 90% of auto exports from Mexico and Canada go to the US, according to the Mexican and Canadian Automotive Manufacturers' Associations. High tariffs and supply chain delays will increase repair times, causing higher costs for living arrangements and rental vehicles, and protracted business interruptions. This could impact the competitiveness of the North American production and manufacturing industry, and the insurance industry.

Vangari concludes: “A global trade war is a looming concern. If tariffs escalate or supply chains get tangled, economic growth could take a hit, which would change the fundamental risk pool for insurers across North America’s region. As broader tariffs on Canada and Mexico remain on hold, businesses and insurance companies must prepare for potential adverse outcomes across the region in the next few years.”

|