Worryingly, 40% are aware of the restriction but are uncertain about the detail. Many overestimated the allowance as almost £7,000 a year. Almost double the real MPAA limitation of £4,000.

Of those who had accessed their pension in the last year, two-fifths (42%) did so to top-up their income, while a quarter (25%) used it to make home improvements and 17% accessed their pension to save their money elsewhere. Over half of people (55%) who have flexibly accessed their pension have also continued to pay into their pot.

Exceeding the MPAA can lead to tax penalties for people at every earnings level. It means future contributions to defined contribution schemes are limited to £4,000 a year, and people lose the ability to carry forward unused allowances from the previous three tax years.

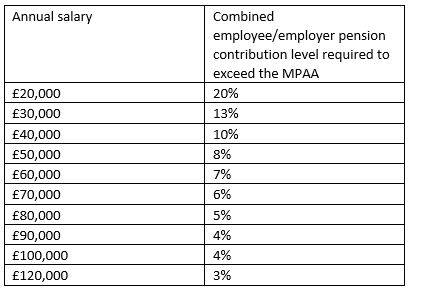

Further analysis by Canada Life shows the contribution levels required to exceed the allowance. The auto-enrolment minimum is set at 8%. If someone chose to continue contributing 8% on a salary of £50,000 they would find themselves on the wrong side of the allowance. Even lower earners could be caught by the restrictions on what are still relatively conservative contribution levels.

Andrew Tully, Technical Director at Canada Life comments on the findings: “The Money Purchase Annual Allowance is quite simply penalising people for doing the right thing. Retirement journeys are changing and it is no longer the cliff-edge event it used to be. Many more people are choosing to retire later for a variety of reasons and continue working in older age, either by reducing their hours, setting up their own business or perhaps embarking on a less pressured career.

“Particularly after the financial stresses of the last year, it is understandable that people have chosen to access their pension savings for any number reasons, perhaps to top up their salary under furlough or to make those essential home improvements. This has become an increasingly popular financial decision as more than £40 billion has been withdrawn from pension savings since the inception of pension freedoms in 2015. This continued growth in the number of individuals accessing their pensions implies that we are seeing more and more working people look to their pension pot to manage their expenses or cover unexpected costs. To then limit their ability to add to their pension pot to £4,000 a year is deeply unfair.

“Given the impact Covid-19 is having on our country there is a strong case for reviewing the MPAA, so those who access taxable income from their pension can re-build their savings once this crisis is over. At the very least the MPAA should go back to the previous limit of £10,000, although my preference would be to scrap it altogether. The Treasury may worry about tax leakage, but the much greater issue in my view is the lack of retirement savings which many people have. Scrapping the MPAA removes an unnecessary complex barrier and may help many who were in financial hardship rebuild their retirement savings.”

MPAA Triggers

The MPAA will apply once an individual first flexibly accesses a defined contribution arrangement (known as a trigger event). This basically restricts the level of tax relievable contributions that can be made to a defined contribution scheme to £4,000 each tax year

These are the most common ways to trigger the MPAA:

• Taking an income payment from a flexi-access drawdown fund

• Taking an income from capped drawdown (in excess of the cap)

• Those who were in a flexible drawdown plan before 6 April 2015

• Taking an Uncrystallised Funds Pension Lump Sum (UFPLS)

Individuals may be able to take benefits without triggering the MPAA, for example, access only tax-free cash from drawdown, or take out a guaranteed lifetime annuity

|