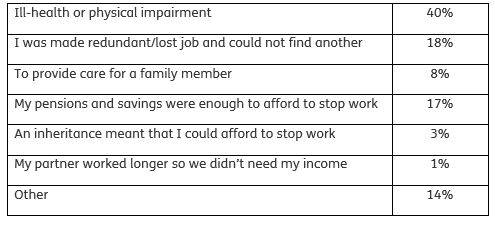

Figures by Just Group found that among 55-74 year olds who retired earlier than expected, 40% blamed health or physical problems, 18% had been made redundant or lost a job and could not find new employment, and 8% said they left to provide care for a family member.

Fewer than one in five (17%) said they retired earlier than expected because they felt their pensions and savings were enough to stop working, 3% said they received an inheritance that made stopping work affordable and 2% said their partner’s income was enough that they could stop themselves.

“The early retirement dream does not always seem to be a happy one,” said Stephen Lowe, group communications director at Just Group.

“Many more people retire early due to circumstances outside their control like health problems or redundancy than because their finances are sufficient to give up work.”

He said that the results have important implications for financial planning, particularly for early access to pension money, and also for policymakers considering future rises in the State Pension Age assuming most people will be able to work later in life.

“Most of us have an idea when and how we would like to retire but we need to have a Plan B in case things do not turn out as we expect.”

Just over half (51%) of the over-55s questioned said they retired earlier than they had expected, with one-third (34%) saying they retired when expected and the remainder (15%) retiring later.

Among all respondents aged 55 plus, retired women were slightly less likely than men to have retired early but of those who did, 68% said it was due to health, redundancy or to provide care to a family member compared to 59% of men.

Only 18% of women retired early because they could afford to stop working because of their own or a partner’s income compared to 26% of men who retired early.

Stephen Lowe said the figures reinforce the need for pension guidance – the free, impartial and independent support offered to the over-50s considering how best to use their pensions – to include information about State Benefits as well as pension options.

“For many people forced out of work early it will be important to fill the financial gap until State Pension kicks in,” he said. “Our own research into benefits take-up by homeowners reveals far too many don’t claim the money they are eligible to receive.”

What was the main reason behind your decision to retire earlier than expected? (Those aged 55 - 74 who said they had retired earlier than expected):

|