Standard Life analysis shows the potential long-term impact of applying savings made through loud budgeting to pension contributions. “Loud budgeting” – being open about what you do and don’t want to spend money on – became a viral financial trend earlier this year, helping people set boundaries with friends and family by honestly communicating their financial constraints.

Now, new research by Standard Life, part of Phoenix Group reveals how comfortable younger generations feel about openly discussing their finances and how many are turning down social activities because of the costs involved, with many preferring to prioritise longer-term financial goals.

Generation Z (those aged between 18 and 27) are more comfortable openly talking about money and their financial situation than older generations. Three in five (61%) of Gen Z are comfortable having these conversations with friends, and 71% are comfortable doing this with family. In comparison, just half of 35 to 54 year olds (49%) and of those aged 55 and over (50%) feel comfortable talking about finances with friends, while 61% of 35 to 54 year olds and 69% of over 55s are at ease discussing this with family.

Meanwhile 7 in 10 (68%) Gen Z adults say they have turned down social occasions because of their financial situation, with 49% saying they’d rather save money towards a financial goal.

Loud budgeting to enhance long-term savings

Younger generations face competing financial priorities with the high cost of living and goals like buying a house likely to top their agenda. For a longer-term view, Standard Life analysis highlights the significant financial uplift loud budgeters could see if they channelled the money saved by foregoing social events into their pension.

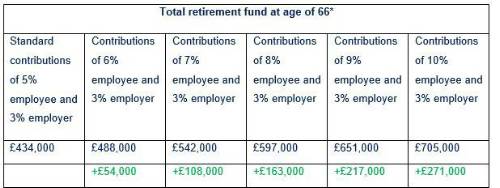

Topping up monthly contributions by just 2% over the course of a career could lead to tens of thousands of pounds more in retirement. For example, someone that began working full-time with a salary of £25,000 per year and paid the standard monthly auto-enrolment contributions (5% employee, 3% employer) from age of 22, could amass a total retirement fund of £434,000 at the age of 66, not adjusted for inflation*.

However, if they were able to save extra through applying loud budgeting and then increased their monthly contributions by 2% (5% employee, 5% employer) from the age of 22, they could accumulate £542,000 by the age of 66* – £108,000 more than standard contributions would achieve.

Making higher contributions could naturally have an even bigger impact on a retirement pot – but even a 1% increase in contributions could produce £54k in additional savings, just under 19 months average salary for a UK full time worker:

*assuming 3.50% salary growth per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

The calculations show that a small increase in monthly pension contributions can have a significant impact over the course of a career, demonstrating the power of compound investment growth. Starting a pension early in life and letting it grow means compound investment growth could build each year, and combining this with increased monthly contributions can have a powerful effect on eventual retirement outcomes.

Dean Butler, Managing Director for Retail Direct at Standard Life said: “The last few years have been financially tough and it’s easy to see why the concept of loud budgeting has taken off. Normalising conversations about money and empowering people to be comfortable talking about how they’re working towards financial goals is healthy, and hopefully makes a difference to people’s short and long-term finances. Our research shows that younger generations feel more comfortable openly discussing their finances than their predecessors, however having an honest conversation about money can benefit people of all ages.

“If those that make additional savings due to loud budgeting channel this towards their pension contributions, they can significantly boost the pension they retire on. While there are always trade-offs between short and longer-team financial goals, consistently paying into a pension from as early an age as possible and topping up payments can make a massive difference over time. Some employers will also match the contributions you make, giving your pot a further boost. If you’re able to save into a pension and increase your contributions above the standard levels, your future self is likely to thank you for it.”

|