The not-for-profit company operates the Options Transfers service, which since 2008 has handled the industry’s contract pension transfers. There are more than 90 brands – pension providers, administrators and platforms – using the service, making Origo’s data the most comprehensive and insightful in the market.

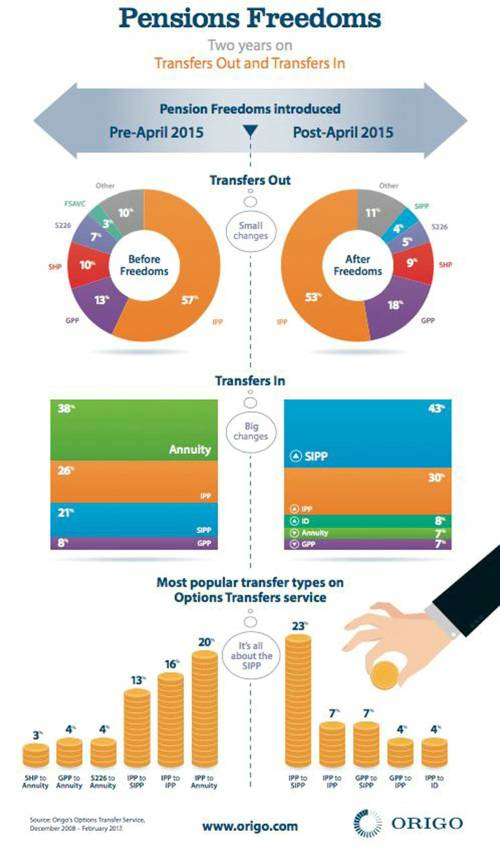

While the percentage split between the sources of the transfers have not altered by any significant amount in the two-year period, the destination of the pension money has notably changed.

Pre April 2015 SIPPs were receiving 21% of transfer money but in the past two years that has doubled to 43%, making SIPPs the clear winner as a result of the changes to the pensions rules.

Individual Pension Plans are the next biggest transfer destination, although they have increased by a smaller percentage, 4%, while income drawdown has also seen an increase, now at 8%.

The most popular transfer type on the Options Transfers service post April 2015 has been from an individual personal pension (IPP) to a SIPP, with 23% of transfers being between these two wrappers.

The definite losers in the same two-year period have been annuities products, which pre April 2015 were receiving 38% of monies transferred and over the past two years have seen just 7% of transfers in.

Overall, there has been a 25% increase in transfer volumes through the Options Transfer service since April 2015.

Paul Pettitt, Managing Director of Origo, comments: “Since the Pensions Freedoms were implemented in April 2015 there has been a clear trend to move into pension vehicles that can help pension holders make the most of the greater IHT and drawdown flexibility offered under the new rules. As our infographic shows – when it comes to pension vehicle popularity since April 2015 it’s all been about SIPPs.”

* Data is for the periods September 2008–April 2015 and April 2015–February 2017.

Key to infographic

Pre April 2015

Free-standing Additional Voluntary Contribution (FSAVC)

Group Personal Pension (GPP)

Section 226 Pensions (S226)

Self Invested Personal Pension (SIPP)

Stakeholder Pensions (SHP)

Post April 2015

Individual Pension Plan (IPP)

Income drawdown (ID)

Self Invested Personal Pension (SIPP)

Individual Personal Pension (IPP)

Group Personal Pension (GPP)

|