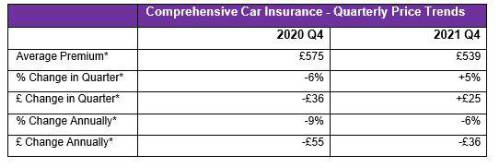

The average cost of car insurance, after falling for four straight quarters, increased for the first time since the autumn of 2020 with a price rise of 5% (£25) in the final quarter of 2021, according to the longest established and most comprehensive car insurance price index in the UK, based on price data compiled from almost six million customer quotes per quarter.

Source: WTW / Confused.com Car Insurance Price Index. *Values rounded to the nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “The impact of motorists making fewer journeys due to the COVID-19 lockdown, combined with intense competition in the industry, caused prices to drop for 12 months through to the autumn of 2021. The rise in prices since then most likely reflects the predicted volatility ahead of the new FCA pricing rules being implemented on 1 January, combined with claims costs increasing since lockdown restrictions eased.”

The cost of comprehensive car insurance over the last three months increased across all regions in the UK, with drivers in Central Scotland experiencing the sharpest quarterly rise at 8% (£33), with average premiums now costing £465, followed by Manchester and Merseyside, where drivers saw a 6% rise (£39). The smallest quarterly increase of 3% (£9) was seen in South West England, nudging average annual premiums up to £355.

Manchester and Merseyside (£685) and the West Midlands (£655) continue to be the most expensive areas outside of the capital, and only marginally less expensive than average premium prices in Outer London (£686). The Scottish Borders is the cheapest region for car insurance, where prices on average cost £342, followed by South West England (£355).

More locally focused data shows motorists in West Central London and Glasgow 1 experienced the greatest quarterly increases, with a double digit price rise in both areas at 10%, increasing their premiums to £1079 and £525 respectively. West Central London also remains the UK’s most expensive postcode for motor insurance, where drivers are paying on average £124 more than drivers in East London, the next most expensive postcode. Despite a 6% quarterly rise in prices, Llandrindod Wells continues to be the cheapest town in the UK, with drivers paying an average bill of £3262 at the end of 2021 for comprehensive car insurance.

The demographic that saw the greatest quarterly increase were young male drivers aged between 21 and 30 who saw their car insurance rise by 6-8%, taking the premiums of those aged 21-25 to £1147 and £858 for those aged 26-30. Male drivers aged between 17 and 20 are still paying the most of any demographic - with premiums increasing by 4% - and now pay on average £1480.

Tim Rourke said: “More pricing volatility is expected in the coming months, with insurers competing to maintain margins as they adjust to the new FCA fair pricing rules. How insurers respond to the new rules through pricing and product strategy will determine just how turbulent the next few months become. Meanwhile, the pandemic will continue to put insurers under considerable pricing pressure as wholesale society changes evolve and disrupt the market, exacerbated by claims inflation potentially rising further in 2022 and the long-term impact of the whiplash reforms still unclear.”

Louise O’Shea, CEO at Confused.com comments: “The increases we’re seeing in car insurance prices are not unexpected. Before the pandemic, Brexit was already causing the price of claims to inflate due to the cost and length of repairs. Now with these issues heightened by the pandemic and therefore putting further pressure on insurers, we can expect prices to inflate even further over the coming months, regardless of any impact the recent FCA changes may have.

“What we could also see now is an incredibly competitive market. Insurers can no longer offer discounts to differentiate between new business and renewal, and so we could start to see many companies looking at the way they are pricing to become more attractive to customers. And with this, insurers could be seeking out as much insight into pricing trends as possible to see how other companies are reacting.”

|