UK equities were the number one selling asset class on the Skandia Investment Solutions platform in November 2013 for the first time in five years.

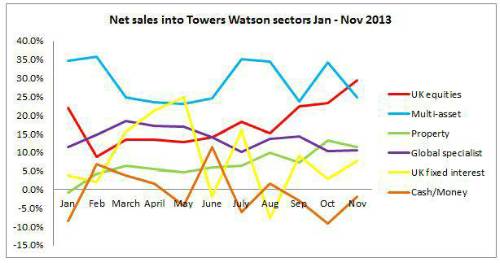

As investor confidence in the UK economy continues to improve, nearly a third (29.4%) of all sales on the Skandia platform in November went into UK equities, up from 23.2% in October. Multi-asset funds have now dropped into second place, falling from a 34.2% share of sales in October to 24.9% in November.

In contrast to the rising popularity of UK equities over the year, UK fixed interest fund sales have declined. The ‘great rotation’ out of fixed interest into equities, which many predicted may have finally materialised.

Property funds continue to prove popular and have maintained their position as the third bestselling asset class. This seems to be a continued reaction to the boosted property market witnessed this year.

Three UK equity funds appear in November’s top ten selling funds, with Cazenove UK opportunity taking up the number one spot. Despite the general move from fixed interest, strategic bond funds continue to sell well with M&G Optimal Income and Artemis High Income appearing in the top 10.

Alistair Campbell, head of investment marketing at Skandia comments:

“For the first time since the financial crisis, UK equities are back on top. Investor confidence appears to have returned and in response investors are seeking strong returns from equities. This is no surprise as the FTSE has continued to perform strongly throughout the year. Additionally, with many UK investors looking for the sustainability of income, in part, driven by the needs of the ageing population saving for or in, retirement, UK stocks are becoming ever more attractive; in contrast to the bond market where yields are under pressure.

“This trend for equities looks set to continue into next year, as UK companies in core sectors such as building and infrastructure benefit from external investment from China. With London reasserting itself as the premier international financial centre, UK equities are likely to remain a popular choice for investors."

|