Last Monday, the Association of British Insurers (ABI) announced that insurance losses from the UK floods caused by storms Desmond, Eva and Frank in December totalled an estimated £1.3 billion. The flood losses, which are likely to be earnings events rather than capital events for most UK property & casualty (P&C) insurers, are credit negative. Given the size of the losses and the typical retention level, we expect the burden to fall mainly on primary insurers, specifically those more exposed to personal and commercial property insurance, with reinsurers ultimately bearing only a minority of the losses.

|

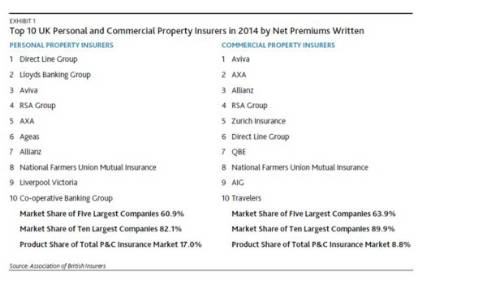

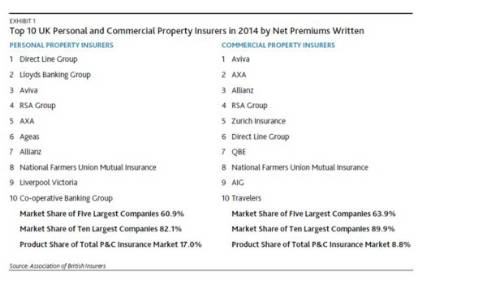

Given their significant personal and/or commercial property portfolios (see Exhibit 1), we expect the most affected UK insurers to include Direct Line Insurance Group plc’s subsidiary UK Insurance Limited (financial strength A2 stable), Lloyds Banking Group plc’s subsidiary Lloyds Bank General Insurance Limited (unrated), Aviva Insurance Limited (financial strength A1 stable), RSA Insurance Group plc’s subsidiary Royal & Sun Alliance Insurance plc (financial strength A2 stable), and AXA Insurance UK plc (financial strength Aa3 stable). Of these, only Direct Line thus far has publicly provided a loss estimate of £110-£140 million, which is below its £150 million per event retention under its property catastrophe reinsurance contract. This means that Direct Line currently does not expect to make any recovery under this contract.

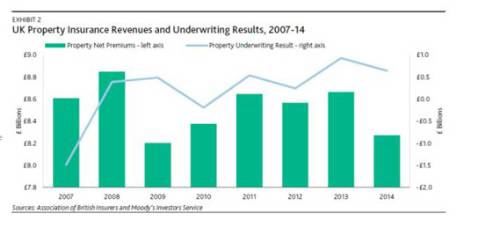

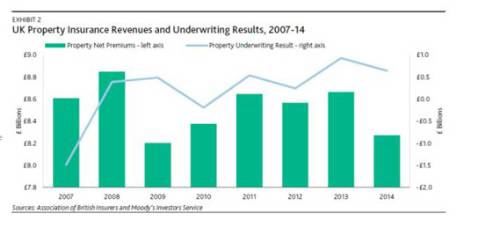

Most of the flood losses are likely to fall on property lines of business, which produced £8.3 billion of net written premiums in 2014, or around 26% of UK P&C insurance premiums, according to the ABI. Assuming constant year-on-year premiums in 2015 for this business line and that all of the losses arise in a single calendar year (i.e., 2015), the loss in itself would negatively affect the UK property combined ratio (the ratio of insurance claims and expenses to insurance premiums) for 2015 by approximately 16 percentage points.

The ultimate effect would be diluted by reinsurance recoveries, although we expect these to be limited. Although the flood losses will negatively affect insurers’ underwriting results, the flood losses will not necessarily lead to an overall underwriting loss for the UK property business in 2015. Despite price reductions, recent underwriting profitability for this business line has been strong (see Exhibit 2), with a combined ratio in 2014 of around 92% producing an underwriting profit of £643 million (these figures include weather-event losses in the year). Additionally, weather-related claims during 2015 before the December storms were minimal.

From an overall portfolio perspective, the UK insurance industry collectively wrote £30.1 billion of net written premiums for UK risks in 2014, according to the ABI. Assuming constant premiums and excluding any reinsurance recoveries, the loss would negatively affect the UK insurance industrywide combined ratio for 2015 by approximately four percentage points. The ultimate effect would be diluted by reinsurance recoveries, although we expect these to be limited.

Notwithstanding their adverse effect on insurers’ underwriting profits, we do not consider the flood-related losses as sufficiently material to halt the continued decline in UK home insurance premiums, which fell around 2% during the first nine months of 2015 for combined (buildings and contents) policies, according to the ABI. Price competition has been increasing because of an influx of capacity and the increasing proportion of household business purchased via price-comparison websites, which have made household insurance more commoditised.

Underwriting margins risk being further hurt as insurers may struggle to adjust rates to adequately

incorporate a levy fee for Flood Re (a not-for-profit reinsurance fund owned and run by insurers) that begins in April 2016, and a rise in the insurance premium tax that began in November 2015.

|