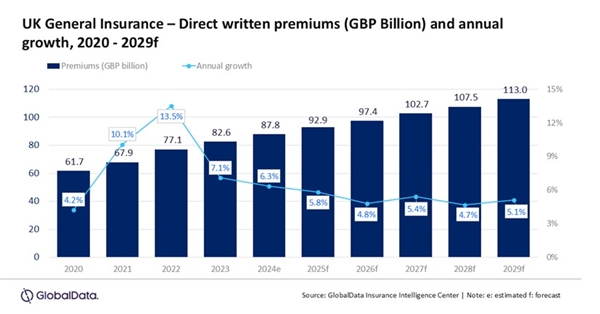

As per GlobalData’s UK General Insurance Report, the general insurance industry in the UK is expected to grow by 5.8% in 2025, driven by the increasing home insurance cost, the rising natural catastrophic events, the government push for greener vehicles, and rising demand for commercial motor insurance.

Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, comments: "The UK general insurance industry is navigating change, driven by evolving consumer behaviors, climate challenges, regulatory changes, competition, and price sensitivity. Overall, the sector anticipates steady growth but must adapt to emerging risks and consumer demands.”

Motor insurance is the leading line of business in the UK general insurance industry, estimated to account for a 28.0% share of the DWP in 2025. It is expected to grow at a CAGR of 2.4% during 2025-29. Factors such as recovery of the economy, increased personal injury discount (Ogden) rates, and expansion of commercial fleets will contribute to the growth of motor insurance. With an increase in commercial activity, government incentives for electric vehicles (EVs), and a push to transition to zero-emission vehicles by 2035, the fleet operators in the UK are increasingly adopting electric vans. This, along with an increase in new car registrations, which grew by 2.6% in 2024, will support the growth of motor insurance in 2025. Fleet sales accounted for 59.6% of the new vehicle registrations in 2024, according to the Society of Motor Manufacturers and Traders (SMMT).

Sahoo adds: “The increase in Ogden rate from -0.25% to 0.5% starting January 11, 2025, will lower motor insurance claims costs and is expected to increase insurers’ profitability. The motor insurance premiums, which registered an average increase of 40% during 2022 and 2023, will not witness such a steep increase further and will give some relief to the policyholders.”

Property insurance is estimated to account for a 25.7% share of DWP in 2025. It is expected to grow by 5.8% in 2025, driven by rising frequency of extreme weather events, including storms and flooding, rising building costs, rising opportunity for contents and renters insurance, and increasing consumer demand for comprehensive coverage.

Sahoo continues: “The increasing frequency of extreme weather events poses challenges, leading insurers to raise premiums and reassess coverage options in high-risk areas. Collaborative investments in flood adaptation infrastructure are essential to mitigate these risks and expand coverage options for vulnerable communities. The integration of smart home technologies is also transforming the landscape, enabling homeowners to detect issues early, which can reduce claims.”

Liability insurance is estimated to account for a 15.1% share of DWP in 2025. It is expected to grow by 5.1% in 2025, driven by growing awareness of cyber threats, as businesses seek to protect themselves against increasing cyberattacks. Additionally, the fatal injury of workers, expected to grow by 3% in 2025, as reported in the Health and Safety Executive’s annual statistics, along with the increased Ogden rate, will support the growth of employers' liability insurance. The evolving needs of consumers and businesses in a rapidly changing environment will continue to support the liability insurance to grow at a CAGR of 7.4% during 2025-29. Personal Accident and Health (PA&H), Marine, Aviation, and Transit (MAT), and Financial Lines insurance products are estimated to account for the remaining 31.2% share of the general insurance DWP in 2025.

Swarup concludes: "The outlook for the UK general insurance market remains positive, with growth driven by regulatory change and evolving consumer needs. Insurers must remain agile and innovative to navigate the challenges posed by climate change and economic pressure. However, the increased Ogden rate is a welcome development for general insurers."

|