Research by David Masters, a Moody's Senior Analyst.

Because most of the new pensions in 2014 are either defined contribution or group personal pension/stakeholder schemes, these pension assets are likely to accumulate on insurers’ balance sheets and are therefore credit positive for UK life insurers because they will increase insurers’ overall assets under management.

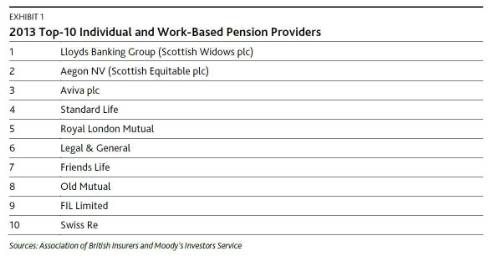

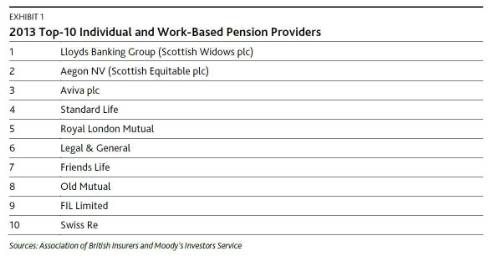

The top-line growth of pensions will most likely benefit insurers that already possess a large market share in defined contribution and personal pension/stakeholder schemes, as well as those with an ability to market their pension schemes directly to employees/employers through the workplace. Such groups include Standard Life Assurance Ltd. (financial strength A1 stable), Legal & General Assurance Society Ltd. (financial strength Aa3 negative), Scottish Equitable plc (unrated), Aviva Life & Pensions UK Limited (financial strength A1 negative) and Scottish Widows plc (financial strength A2 stable). Exhibit 1 shows the top 10 UK pension providers in 2013 based on total gross premiums written.

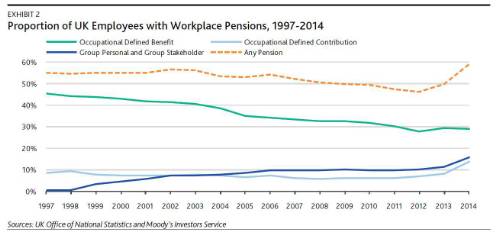

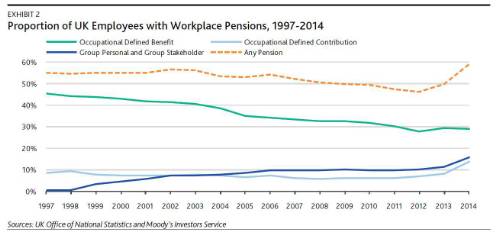

The material increase in the percentage of employees saving into a private pension in 2014 is a reversal of previous trends, with a 10% decrease between 2002 and 2012 (Exhibit 2, dotted line). In 2014, a higher proportion (59.2%) of people saved into a pension than at any time since records began in 1997, and we expect the percentage saving into a workplace pension to further increase as the auto-enrolment scheme is extended to cover smaller employers over the next two to three years. Based on recent trends, we estimate that as many as 70% of employees will be saving into a workplace pension by the end of 2018.

The average employee now covered under an auto-enrolment scheme likely earns less than the average UK weekly wage of £483 because, according to the ONS, more affluent employees are more likely to already be members of an occupational pension scheme. However, using the £483 figure, new auto-enrolment savers added approximately £2.0 billion1 of pension assets last year. Once the auto-enrolment scheme is fully established, the amount will increase to an additional £7.4 billion of new pensionable assets per year.

Employees who do not opt out of auto-enrolment are currently only required to contribute a minimum of 1% (including tax relief) of their eligible earnings into the scheme. This will increase to 4% (including tax relief) by October 2018, possibly resulting in higher opt-out rates as employees are unwilling to divert a growing part of their salary to their pension, which may limit asset flows onto insurers’ balance sheets over time. To date, opt-out rates among eligible employees have been lower than analysts expected, at around 10%, according to the UK Department for Work and Pensions.

However, auto-enrolment products also have lower margins than other products UK life insurers sell. Furthermore, the government-administered National Employment Savings Trust scheme is a low-cost competitor with insurers’ product offering in this arena, particularly among employers with relatively few employees. Additionally, the profitability of auto-enrolment schemes for insurers is low. In March 2014, the UK government announced that auto-enrolment pension fund annual management fees would be capped at 0.75% of assets.2 We also think it likely that this cap will decline over time, further negatively pressuring the profitability of auto-enrolment schemes in future. Although we expect these profitability pressures to continue, we consider auto-enrolment schemes a scale play and thus increased asset flows onto insurers’ balance sheets are credit positive.

|