Compared to 15 countries including USA and Japan, workers in the UK were the second most likely globally to cite employment-related reasons for saving for retirement, with 25% of workers saying that being automatically enrolled was the nudge they needed.

The introduction of auto enrolment has been successful in ensuring millions in the UK are saving for their retirement. However, experts have concerns about the levels of participation in workplace pension plans when auto-enrolment contribution rates rise.

It’s therefore very positive that on average, UK workers would support paying up to 7% of their annual salary into a pension every year, more than double the current auto-enrolment default rate (3%) and above the level coming into force in 2019 (5%). Younger workers would support an even higher contribution level, at 8%. In fact, nearly 1 in 6 of those in their 20s would be willing to pay between 11% and 15% of their salary towards pension saving.

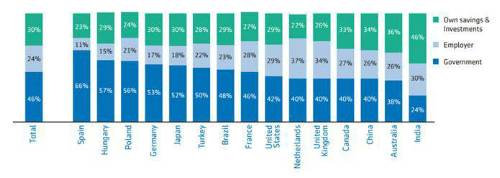

Globally, people expect workplace retirement plans to fund only 24% of their overall retirement income. People in the UK people expect more than a third (34%) of their retirement income to come from workplace pensions, second only to the Netherlands (37%).

The Aegon Retirement Readiness Survey 2018: People’s expected retirement income (proportion by three broad sources)

The state pension plays an important part in providing an income in retirement in many countries, with people in the UK expecting it to fund 40% of their income, compared to nearly half (46%) globally. In five of the 15 countries surveyed, people expect more the half of their retirement income to be funded by government benefits: Spain 66%, Hungary 57%, Poland 56%, Germany 53% and Japan 52%.

Kate Smith, head of pensions at Aegon, commented: “Our findings repeatedly show that workers in the UK place great emphasis on workplace pensions in helping them to build their retirement income. Saving in a pension through your employer has become a natural part of working life in the UK today, with people embracing saving in this way.

“There’s also a growing appreciation that the level of retirement income is dependent on the contributions individuals and their employer make throughout their career, leading to a desire to pay more. There’s also strong feeling that employers should contribute into a workplace pension with 82% of UK workers saying they should.

“There’s some concern that increasing auto enrolment contributions for employees would result in some people stopping their contributions. However, our research is a strong endorsement that not only will people take the increases in their stride, they’re realistic to appreciate that a comfortable retirement requires saving at higher rates and are prepared to pay more. While young people face many financial pressures, it’s encouraging that many are willing to save more and regular saving from a young age will set them up well in the long run.

“Across the globe people are expected to take on greater individual responsibility to save for retirement. As the reliance on governments shifts, we need to ensure that access to saving is universal, allowing employed workers to save for retirement as well as alternative arrangements for the self-employed and those not in the workforce.”

Further information

14,400 workers and 1,600 retired people were surveyed by Aegon in 15 countries across the Americas, Europe, Asia and Australia between 29 January and 19 February 2018.

|